ID scanners for banks

Reduce fraud and identity theft, streamline account opening, and improve customer service with our ID scanners for banks and enhanced KYC/AML solutions.

ParseLink for Banks

Leverage ID scanning for in-branch identity verification

New! Scan IDs using Digital Check scanners

Now available! Add ID scanning and data automation to your existing SmartSource check scanner. Integrate identity proofing directly into your teller lane – no additional hardware required.

Enhanced due diligence with third party checks

An ID scanner for banks can do more than just scan an ID. It can be paired with deep identity proofing to give you confidence about every individual with whom you do business.

DMV Database Checks

Check customer identity against DMV databases in all available states to confirm ID issuance.

IdentiFraud Checks

Check identity against the SSA, known fraud lists, utility records, and public service records.

Criminal Background Checks

Query court records across the US to perform a criminal background check against a scanned ID.

OFAC Checks

Check against the Office of Foreign Asset Controls list of criminals and money launderers.

PEP List Checks

Determine whether a customer is considered a Politically Exposed Person by checking against the PEP List.

Looking to integrate custom lists or other data sources?

Banks & Credit Unions

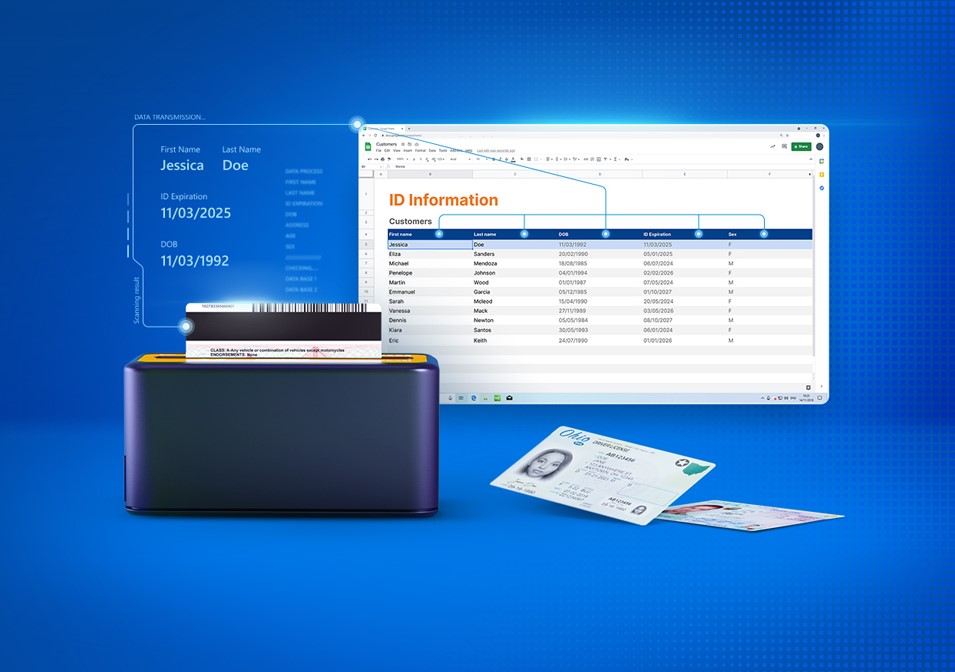

Data automation

Clean, accurate data is parsed from the ID directly into your key systems directly from the ID scanner.

- Instantly ingest data

- Save an image of each ID

- Sync data directly into your bank’s key software and systems

- Perform security checks on each ID

- Install in minutes

- Streamline account withdrawals, loans, and other processes

Banks & Credit Unions

Identity proofing

With our ID scanner for banks and financial institutions, simply scan an ID to quickly, easily, and securely verify customer identity when onboarding new accounts or assessing credit worthiness.

- 2D barcode security checks

- Hologram checks

- Watermark checks

- State format checks

- Data format checks

- Address validation

- DMV data verification

- SSA identity checks

Benefits of ID scanning for banks

Using an ID scanner at your bank or credit union can greatly improve customer experience.

Detect suspicious IDs

Detect fake IDs by detecting barcode anomalies, or through ultraviolet and infrared ID authentication to catch the vast majority of fakes.

Eliminate typos

No more fat fingers or misspellings. Clean, accurate data is parsed from the ID directly into your CRM or banking software with no need to type.

Reduce paperwork

Save employee manhours and paper by removing the need to make photocopies. Automatically upload an image of the ID directly into the customer profile.

Easy KYC/AML

Perform instant checks against OFAC and PEP lists to do your due diligence to prevent money laundering, avoid fines, and stay compliant with federal standards.

Learn how a rapidly growing regional bank implemented digital identity verification during onboarding to greatly reduce fraud.