IDScan.net

Identity Verification Technology

-

Visitor management software for schools can vastly improve daily processes and increase security. Here are the top features for schools.

-

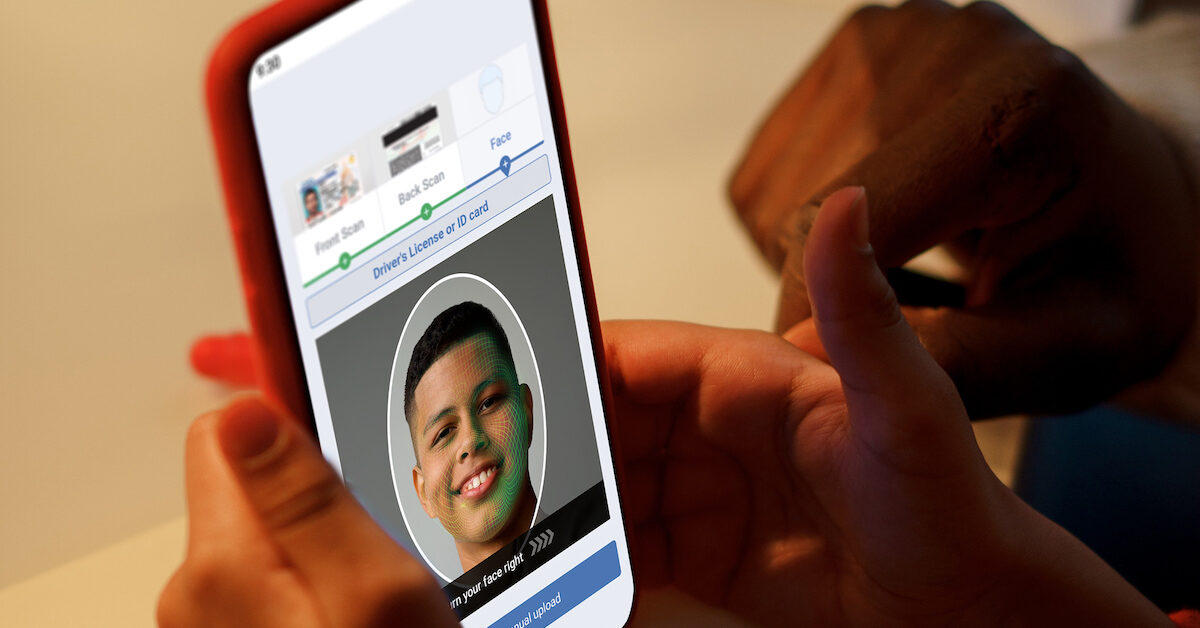

Overview of verification selfie with ID card technology used for confirming identity and matching a selfie to the photo on an ID.

-

Top identity verification trends for 2024 – digital IDs, eCommerce age verification legislation, and growing sophistication of fake IDs.

-

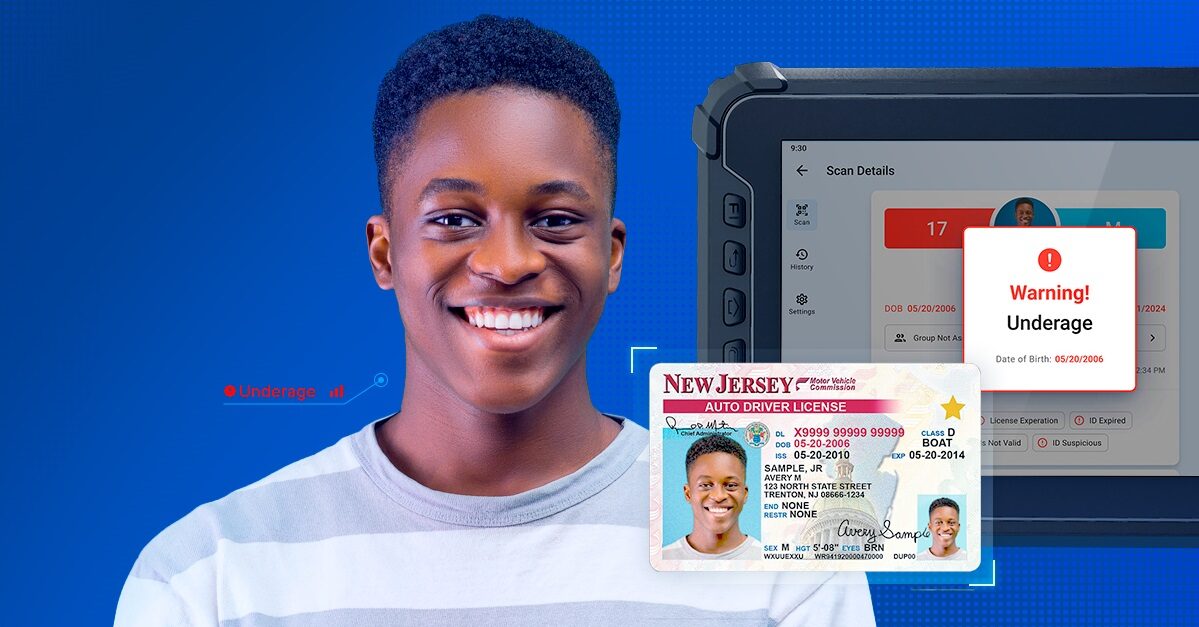

Not all ID verification is created equally. Many businesses think they are performing age verification, when they aren’t equipped to do so.

-

IDScan.net highlights recent data on digital identity verification (DIVE) statistics and trends. Read more here.

-

Identity Verification as a Service (IDaas) is a service that aids businesses in verifying the identity of their customers.

-

Learn about “fullz” aka full credentials, and how fraudsters are using hacked information to steal identities and impact your business.

-

Identity verification methods are moving toward a biometric landscape in an attempt to reduce fraud. Here are some of the most common types.

-

Synthetic identity fraud is a type of fraud where criminals create a new identity by combining real and fake info. Learn how to prevent it.

-

The latest updates to VeriScan for Windows. Eligible customers will now have access to a greatly improved VeriScan product for Desktop use.