Identity verification for fintech businesses

Verify identity remotely without sacrificing the customer experience.

Digital identity verification for fintech

Meet compliance standards with a streamlined customer onboarding experience

The growing threat of fintech fraud

The growing fintech industry is a hot target for fraudsters and criminals.

FTC estimate on total fintech fraud annually, up 44% from 2021.

Average share of total fintech revenue lost to fraud annually.

Small fintech firms lose 57% more than larger businesses.

Fintech

Remote ID validation

Our software starts by using optical character recognition (OCR) to read the data on the front of the ID, and match the ID format against our AI-powered validation engine.

We then parse the back of the identity document and check that the data is a match. We also perform more than 75 algorithmic checks to look for known “tells” that may indicate an ID is fake.

- OCR reading of ID text

- Front/back matching

- 2D barcode security checks

- Scan using customer device

What sets our remote ID validation apart

We pride ourselves on catching the most fake IDs to prevent fintech fraud.

2D barcode security

We check each ID against our template library and AI-algorithms to detect up to 50% of fake IDs from a barcode scan alone.

No per-scan cost

Because we own our own document library, there is no per-scan cost for remote ID validation of North American documents.

Superior OCR

Our OCR is capable of reading and ingesting all text from a document, and instantly compare it to the information in the barcode/MRZ.

Speedy results

Our remote ID validation is lightning fast, which means a smooth, efficient experience for your end customers – no added friction.

Fintech

Identity proofing

Next, the software accesses the front-facing camera on the customer’s mobile device and opens a window with a framed selfie.

Our software guides the customer through several randomized anti-spoofing exercises to confirm liveness, and creates a 3D mesh model of the customer’s face.

Then the mesh model is compared to the face in the ID photo to confirm identity.

- Anti-spoofing

- Prevent 3D mask attacks

- Prevent photo, replay attacks

- Liveness checks

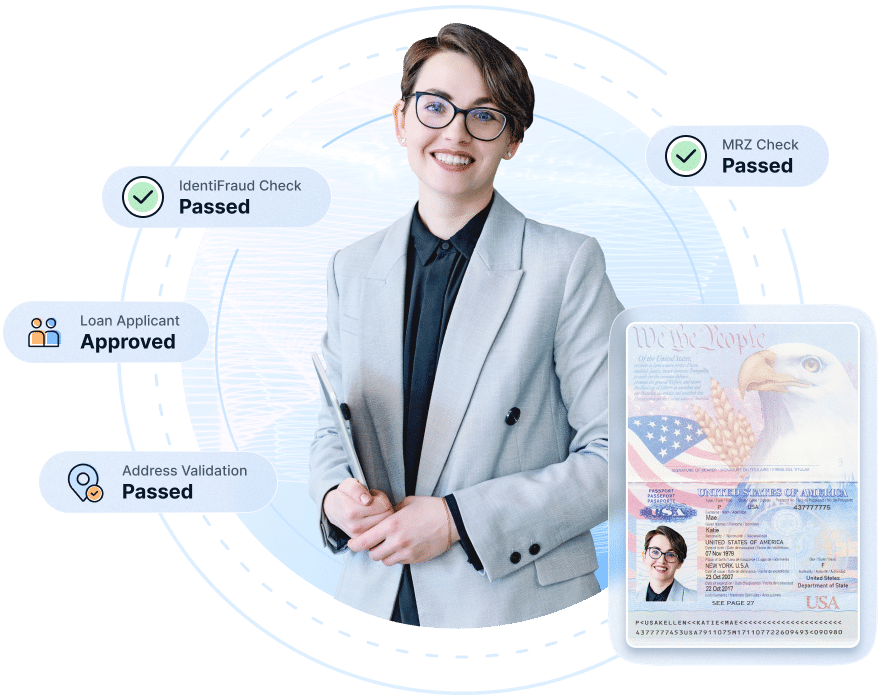

Add third party checks

After the ID has been validated, and identity confirmed via face match, fintech businesses can layer on additional checks to meet the highest KYC/AML standards.

DMV Database Checks

Check customer identity against DMV databases in all available states to confirm ID issuance.

IdentiFraud Checks

Check identity against known fraud lists, utility records, and public service records.

Criminal Background Checks

Query court records across the US to perform a criminal background check against a scanned ID.

SSA Checks

Query the Social Security Administration for a federal level identity check.

OFAC/PEP List Checks

Check customers against the OFAC, PEP, and sanctions lists for KYC/AML compliance.

Looking to integrate custom lists or other data sources?

Learn how a growing regional bank stopped new account fraud with a layer approach to fintech identity verification.