DIVE

Digital Identity Verification API

We offer the most lightweight, affordable global IDV engine in the industry. With client-side and server-side tools, optional third party checks, and detailed reporting, you can insert identity proofing directly into your application, software, eCommerce store, or self-service kiosk.

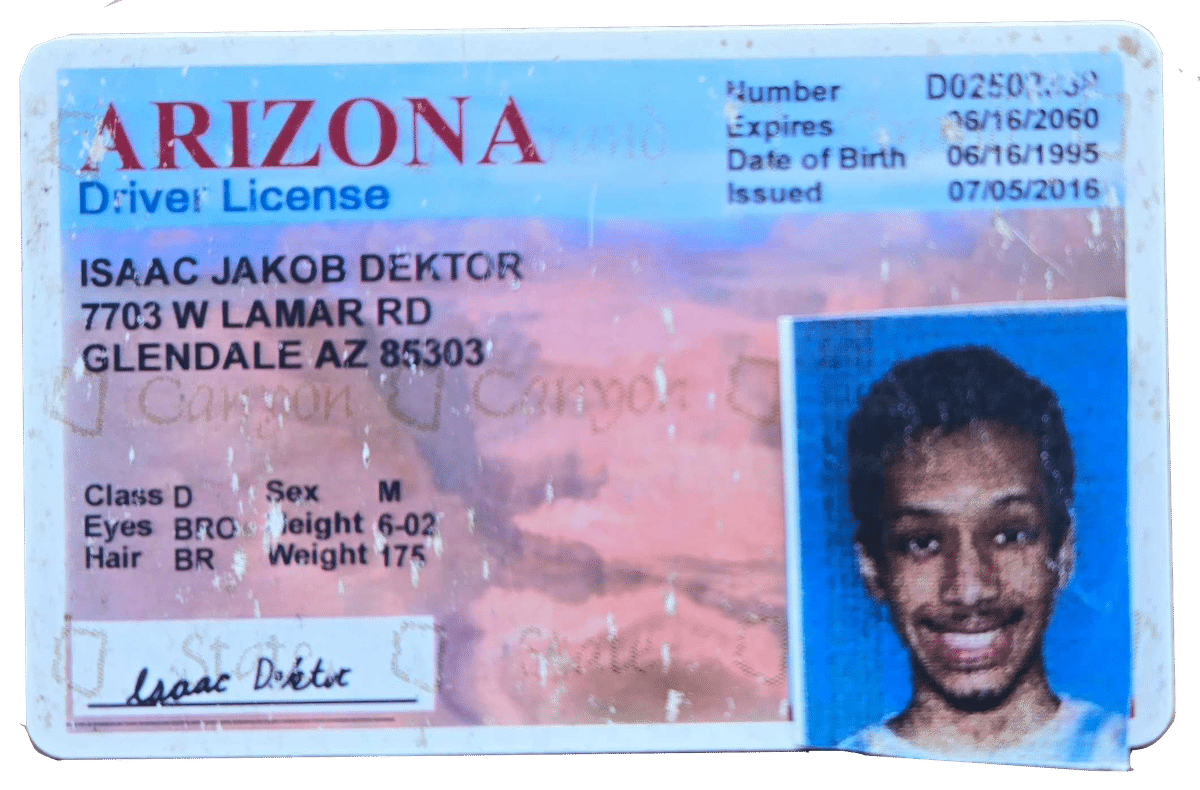

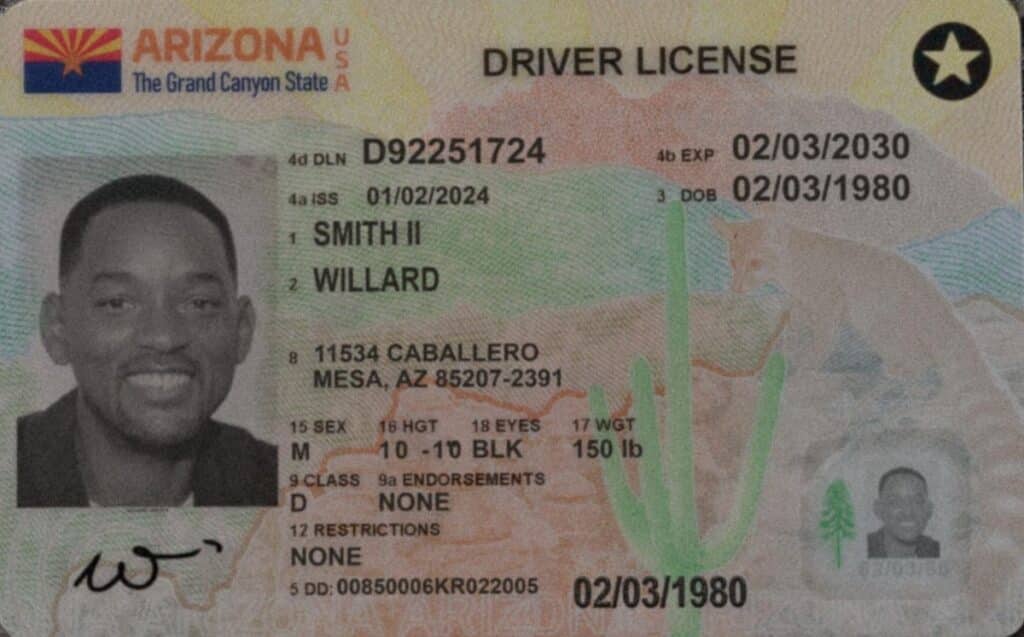

Verify the identity document

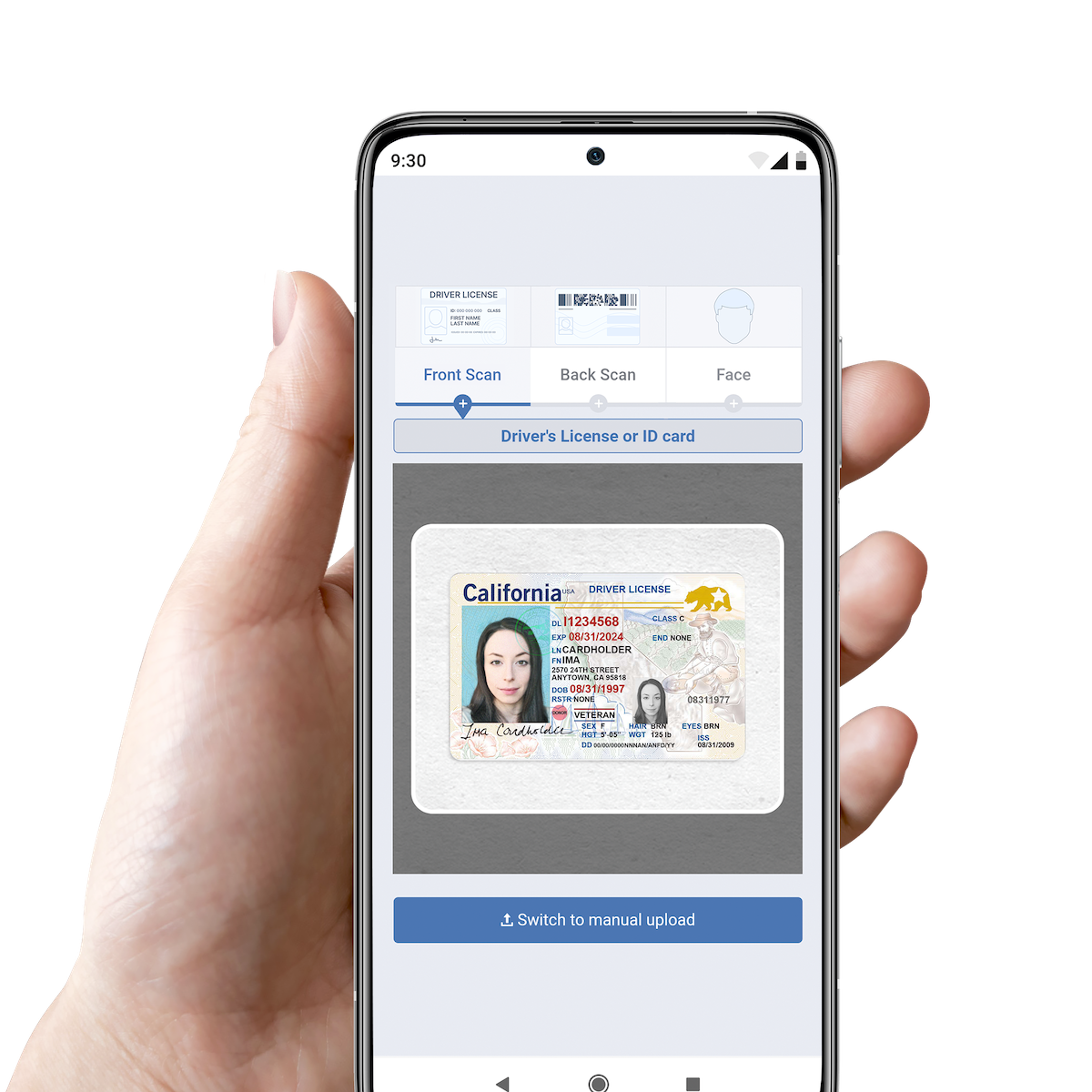

We leverage the user’s mobile device camera to capture a photo of the front and back of their identity document. Our AI rapidly analyzes the credential to determine legitmacy.

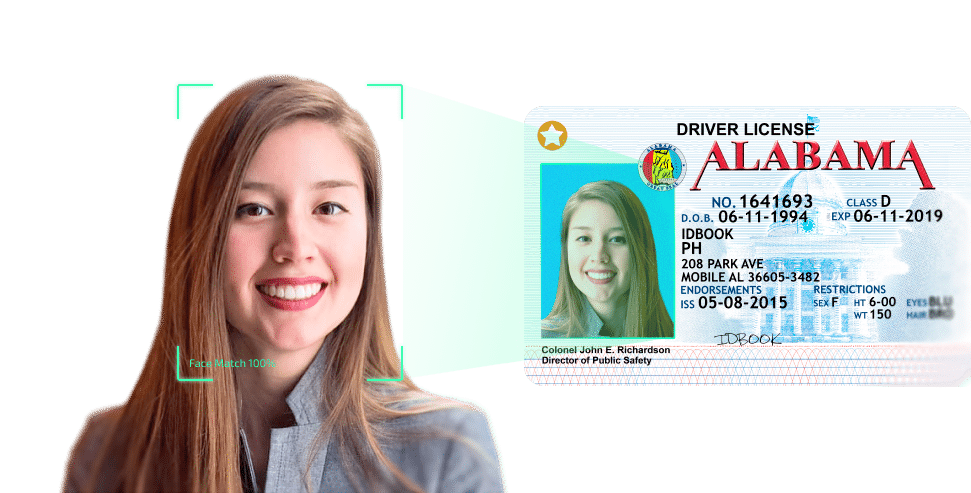

Anti-spoofing selfie

The user walks through randomized liveness checks on video, and our software uses face matching technology to confirm they are the rightful ID holder.

Layer additional risk scores

Optionally, add in third party data sources to provide additional risk data and deeper KYC,

Verify identity in <15 seconds

DIVE API

IDScan.net’s Digital Identity Verification Engine leverages our identity platform to provide everything you need to verify end-user identity quickly, accurately, and securely.

What is

Digital identity verification?

First, digital identity verification software performs AI-driven analysis on the customer’s identity document. This includes algorithmic analysis of the barcode, and high-resolution inspect of the ID template looking for indications that the document may be fraudulent. Our remote ID validation is rapid and accurately flags fake IDs at a high rate.

Identity Check API

Verify identity in less than one minute to streamline onboarding and account creation with DIVE

Digital identity verification

Barcode security checks

Many tools can read and parse the data on the ID, but our remote ID validation takes it a step further by performing more than 100 algorithmic checks on the ID’s barcode. This allows us to catch low quality fakes and fake IDs with 2D barcode (PDF417) anomalies.

- Data format check

- State “tell” check

- Barcode position check

- Jurisdictional check

- Barcode size check

- Front/back crossmatch

Digital identity verification

Face matching via selfie

We harness the power of your customer’s mobile phone camera to perform identity verification using a live selfie video. Our face match technology easily confirms that the live user is the same individual as the person in the ID photo.

How long does your face matching take?

The face matching process takes <10 seconds from the time the user opens their mobile camera. The digital identity verification API efficiently creates a mesh template from the ID photo, and then rapidly applies it to the live user on camera, returning a result as soon as it determines whether the face is a match or not.

Does DIVE API face match include anti-spoofing?

Yes. The system performs multiple anti-spoofing checks, protecting against photo attacks, replay attacks, and 3D mask attacks. Click here to learn more about our anti spoofing process.

Does DIVE API face match include liveness checks?

Yes. We offer multiple, randomized liveness checks embedded into the selfie workflow to ensure the individual is a live, legitimate person.

Combatting AI-generated deepfakes

See how DIVE stacks up against AI-generated fake IDs used to perpetrate deepfake scams.

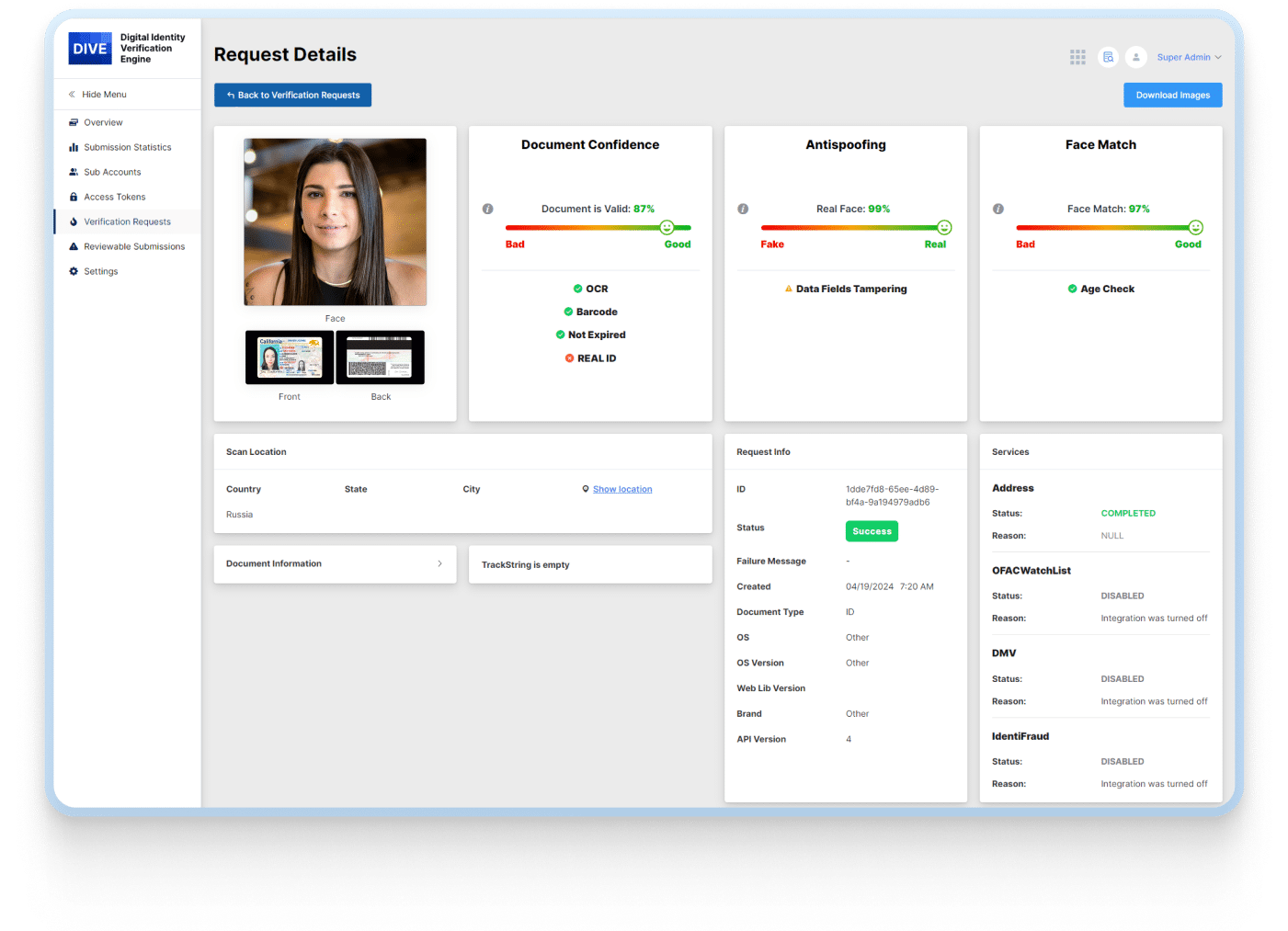

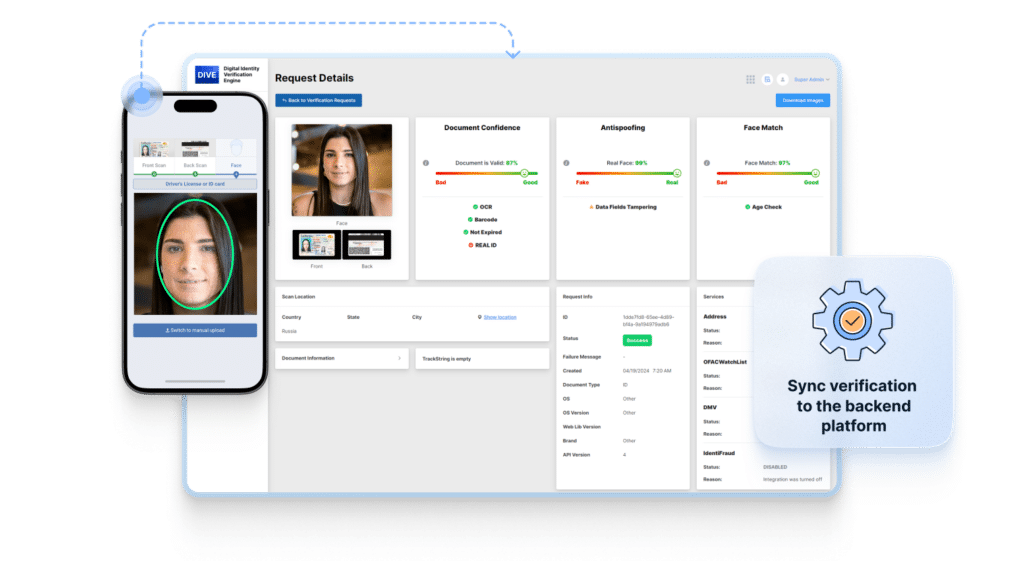

Track your verifications from a central, cloud-based portal

Easily view the total validations initiated, data parsed from the ID, results of third party checks, and volume by day, week, and month.

Suspicious activity monitoring

Flag repeated attempts to onboard with the same document.

Flag fake IDs

Detect when documents are fake or have been digitally altered.

Manually review submissions

View your history to allow for manual review of entries.

Confirm identity data with third party checks

Deepen your understanding of each customer by checking their data against a third party database.

DMV Database Checks

Check customer identity against DMV databases in all available states to confirm ID issuance.

IdentiFraud Checks

Check identity against the SSA, known fraud lists, and OFAC/PEP for KYC/AML compliance.

Looking to integrate custom lists or other data sources?

Digital identity verification

How to integrate DIVE API

What operating systems are compatible with DIVE API?

DIVE API is a web-based API, which can be integrated into any web-based tool. If you require full, native integration you can leverage similar tools using our SDKs.

What percentage of individuals is DIVE API able to successfully verify?

We strive to verify 97% of individuals in 12 seconds or less.

How do you calculate risk threshold inside DIVE?

Our customers have ultimate flexibility to place emphasis on each of the variables related to identity verification, ultimately creating their own blended risk score an determination of which transactions are a “pass” and which are escalated for manual review.

DIVE API

Global document coverage

We accept and verify more than 10,700 documents in more than 250 languages including passports and drivers licenses from around the world.

- North American drivers licenses & IDs

- Global passports

- Global drivers licenses

- National documents from 140+ countries

ID reading & parsing

More than 10,700 documents can be read and parsed using DIVE API and data automation.

ID authentication

We are rapidly expanding the library of global documents which can be authenticated.

Third party checks

We offer access to multiple third party identity checks for North American customers.

How DIVE API works

Digital identity verification (DIVE) API uses ID scanning and selfies to securely verify user identity. Our Adaptive AI technology performs deep analysis to give you confidence in the legitimacy of an identity, even when you can’t authenticate in person.

Snap a photo of the front of the ID

The customer will use the camera on their mobile device to capture an image of the front of their ID. Using optical character recognition (OCR) our software ingests all of their identity data.

Snap a photo of the back of the ID

Next, the customer takes a photo of the back of the ID. Our software ingests and reads the data stored in the 2D (PDF417) barcode and compares it to the data on the front of the ID.

Selfie face match

The customer is guided through a series of liveness checks and anti-spoofing exercises while our software creates a 3D mesh template of their face and compares it to the photo on their ID.