Overview of Florida ID scanning laws

Florida has 6 laws which we consider relevant to ID verification, in addition to other laws which may related to age verification, identity verification, KYC, privacy, and biometrics.

Can you scan an ID in Florida?

Yes. However, Florida law regulates a business’s ability to scan IDs and to use information obtained from a scan in some instances. Due to the limitations around ID scanning and data collection from a “swipe,” some companies prefer to use OCR to read the information on the front of the ID.

Can individuals in Florida request that their ID not be scanned?

Yes. If an individual does not want the business to scan their ID, the business may manually collect personal information from the individual. The individual’s request for manual collection alone cannot be the basis for withholding the provision of goods or services.

Can you save data from a scanned ID in Florida?

Yes but consumers must give consent. As long as an individual is informed of (i) the type of information collected and (ii) the purposes for which the collected information will be used, the individual may consent to the business scanning the individual’s ID to collect and store personal information.

Can you scan IDs without consent in Florida?

A business may scan an individual’s ID without consent only for one of the following purposes.

- To verify the ID’s authenticity or the individual’s identity if the individual pays with a method other than cash, returns an item, or requests a refund

- To verify the individual’s age when providing an age-restricted good or service

Information so obtained my be stored and shared for preventing fraud or other criminal activity, but may not be sold or stored/shared for any other purpose. These laws do not apply to financial institutions.

Does Florida offer affirmative defense for ID scanning?

No. Florida does not offer affirmative defense for ID scanning.

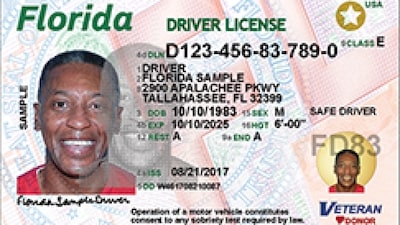

What types of IDs does Florida issue?

Florida issues drivers licenses and state IDs, including REAL ID, and CDLs. Florida does not issue non-domiciled CDLs. They had a short-lived Florida mobile ID but this was pulled from the app stores in 2024.

Individual Florida ID verification laws

ID verification for social media and adult websites

Florida requires age verification to keep minors from accessing social media sites and online pornography. Enacted 1/1/2025

Age verification for alcohol sales

Florida provides an affirmative defense for alcohol sales to a minor if the minor presents a fake ID.

ID scanning for tobacco sales

Florida provides an affirmative defense for tobacco sales to a minor if the minor presents a fake ID.

Age verification for working in adult establishments

Florida requires adult establishments to check IDs and verify age of employees. Enacted 7/2024

ID verification for notaries

Alaska requires “credential proofing” by notaries, so the ID’s validity be proven by a third party source such as ID scanning software. Enacted 2022.

ID scanning for check cashing

Florida requires ID verification and data collection at the time of check cashing.

ID scanning for foreign currency exchange

Florida requires ID verification and data collection at the time of foreign currency exchange.

Florida definitions related to ID scanning

(a) “Personal information” means an individual’s name, address, date of birth, driver license number, or identification card number.

(b) “Private entity” means any nongovernmental entity, such as a corporation, partnership, company or nonprofit organization, any other legal entity, or any natural person.

(c) “Swipe” means the act of passing a driver license or identification card through a device that is capable of deciphering, in an electronically readable format, the information electronically encoded in a magnetic strip or bar code on the driver license or identification card.

Data privacy laws in Florida

Florida’s data privacy laws include the Florida Information Protection Act (FIPA) of 2014 and the Florida Digital Bill of Rights (FDBR) of 2024. Additionally, they have specific laws related to protecting the privacy of minors, and outlining penalties for personal data theft.

HB691 related to personal data theft

SB 242 related to consumer data privacy and credit freezes