eKYC software

Fight fraud and simplify the customer onboarding process with our enhanced digital identity verification, including multi-source risk scoring, AI-driven ID validation, and advanced liveness and anti-spoofing technology.

Preventing fraud in digital banking

What is eKYC?

Electronic Know Your Customer is a framework for securely verifying identity in a completely digital or online environment. It is the digital version of the previous KYC process and regulations which were put in place to prevent money laundering and protect banks from being unwittingly used in fraud schemes.

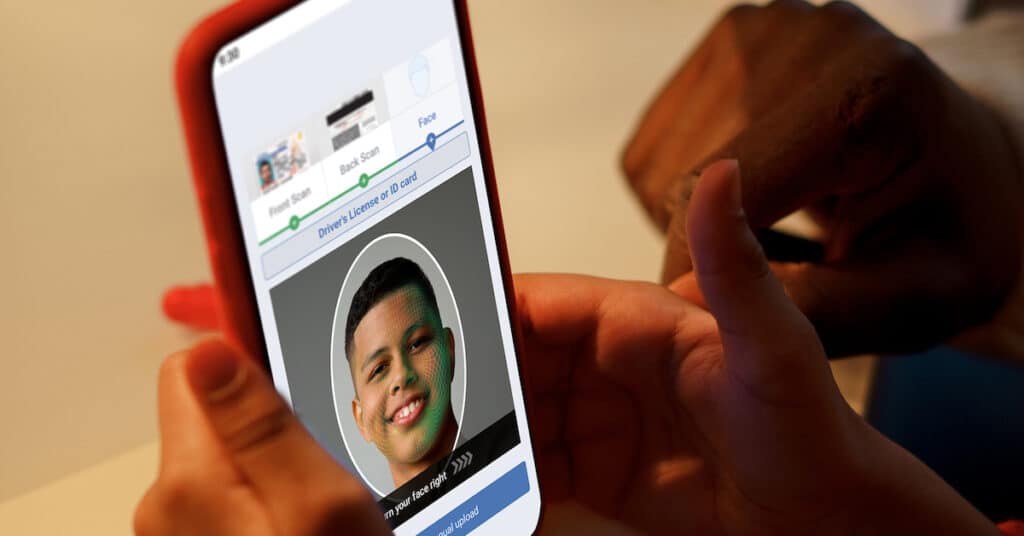

Digital document verification

The customer presents a drivers license, passport, or ID card, and the eKYC software confirms this is a legitimate credential.

Biometric authentication

Most commonly, the customer takes a selfie video, which is matched against the photo on their previously verified ID.

AML & Risk Checks

After identity is confirmed, eKYC requires checking individuals against databases that contain flagged individuals, particular AML and PEP lists.

eKYC third party risk check library

Enhance your eKYC by checking identity against international databases.

DMV Database Checks

Check customer identity against DMV databases in all available states to confirm ID issuance.

IdentiFraud Checks

Check identity against the SSA, known fraud lists, utility records, and public service records.

Criminal Background Checks

Query court records across the US to perform a criminal background check against a scanned ID.

Canadian DMV Database Checks

Check customer identity against Canadian DMV databases in all provinces.

Phone Number Verification

Ensure the customer’s phone number matches telco records, and is associated with an active account.

Social Security Database Checks

Verify SSN and against the Social Security Administration’s records.

OFAC List Checks

Check each customer against OFAC and EU sanctions lists to prevent money laundering.

Politically Exposed Persons Checks

Query global PEP lists to determine if individuals are politically exposed.

Looking to integrate custom lists or other data sources?

eKYC

Ongoing monitoring and re-verification

Ongoing monitoring is a critical component of eKYC that ensures customer identities and risk profiles remain accurate and compliant long after initial onboarding. Unlike traditional KYC, which is often a one-time check, eKYC enables continuous surveillance through automated tools that track changes in customer behavior, transaction patterns, and exposure to risk indicators.

Advanced eKYC systems integrate real-time data feeds and AI-driven risk scoring to flag anomalies such as unusually large transfers, or login attempts from suspicious locations, which can trigger alerts or automated re-verification.

Re-verification against PEP/OFAC lists

eKYC allows for continuous re-checks against lists of high risk or sanctioned individuals based on anomalous behavior or on a regular cadence.

Biometric re-verification

Prompting the customer to submit a new selfie can protect against account takeover and hacked user profiles.

Two-factor authentication (2FA)

To verify identity, eKYC can be used to send a one-time password or a a biometric login to the device originally used for sign-up.

Where to implement eKYC

Electronic KYC can be used in account onboarding, and many other digital use cases to verify identity and prevent fraud

KYC/AML

Watchlist & database checks

Through our partners we are able to access global sanctions lists and watchlists to meet the most stringent KYC/AML standards. These include global sanctions and watchlists, political exposure lists, adverse media lists, Interpol wanted lists, and proprietary fraud lists.

eKYC Frequently Asked Questions

How do you authenticate documents remotely?

Our digital identity verification technology performs algorithmic checks on ID using the camera on the customer’s mobile device. This allows us to assess the ID’s legitimacy as the first layer of fraud prevention and eKYC process.

Can you perform eKYC without document verification?

Identity documents typically perform the basis for understanding your customer. Remote ID validation can assess the document’s authenticity, and face matching can ensure the individual matches their ID photo. PII can also be parsed from the ID and fed into third party database queries, which can be used for more robust risk scoring. There are KYC workflows that rely on device-based authentication but they don’t typically meet the standards for high compliance industries.

Which watchlists must you check against during eKYC and AML processes?

The required watchlists vary by industry, use case, and risk. However, most financial transactions must be checked against OFAC lists, sanctioned individuals lists, and politically exposed persons (PEP) lists.

How does biometric authentication work in eKYC?

A facial template is created using the photo on the customer’s ID. Later, when they initiate the selfie process, a 3D template is created and compared to the ID photo. This template can be stored and used again for re-verification to ensure the original account holder is still the same person performing actions in their account.

Can you perform eKYC without biometric authentication?

Identity proofing typically requires use of some type of biometric identifier. Face match is easy to use because it can be compared to a government-issued ID, and requires no specialty hardware as compared to iris-based verification, fingerprint verification, or verification using other biometric markers.

What is anti-spoofing?

Spoofing is a broad term that encompasses any attempt to fraudulently fool a facial recognition tool. Our anti-spoofing technology protects against photo attacks, replay attacks, and 3D mask attacks.