When identity fraud started and how it has evolved

Have you ever really needed to renew your car’s warranty? Probably not. You also did not win a free $100 gift card randomly from Amazon either. These are all schemes to get your personal information. It’s a good thing you hung up or deleted that email because otherwise, you would have been subjected to identity fraud. While it may seem apparent to you, many are unaware of these schemes and are at risk for identity fraud.

What is identity fraud?

The term identity fraud was first used in 1964, it has since evolved into the organized crime it is today. Identity Fraud (also known as identity theft) is the use by one person of another person’s personal information, without authorization. This typically results in abuse of the person’s information by sharing it with others or using it for their financial gain.

Today, there are many ways scammers go about getting a person’s personal information, most times unbeknownst to them.

Shoulder surfing is when someone gathers a person’s information from over their shoulder. This has become easier as our information moved to our phones, and those phones upgraded to bigger screens.

Pre-approved credit cards often get sent in the mail. They sometimes find their way to other homes, and other times people find the full papers in the trash and open the account without the person’s consent.

Spam calls and emails as referenced before are a very real and frequent occurrence. While more tech-savvy individuals may know what the goal of these emails is, some are unaware and vulnerable.

The scariest thing is, this is an ever-evolving industry. Like a virus, as society gets better at avoiding these ploys, they get better at how they go about them.

The origin of identity fraud

The idea began with criminals long ago, wanting to escape capture. They would often murder innocent people to steal their identities. This was so that they can continue to live their lives without being imprisoned for their crime. Why was this so easy to do? This was long before there were any widespread identifying documents like photo IDs and social security numbers. This was a time when someone’s identity was determined by their word as well as a person’s signature.

When phones became a household staple identity thieves used them to their advantage. They would call and claim that a person won money and request their personal information in order to release it. These are still used today and make up a sizable percentage of all identity fraud ploys.

From phones, criminals then found another weak spot: people’s trash. Not everyone was disposing of their information properly. This made them vulnerable to dumpster divers. These people would go through trash and find documents with sensitive information. They would then use the information they found to their benefit.

As people began to be more wary of sensitive documents, the internet was becoming a part of everyone’s day-to-day lives. These identity thefts have moved quickly to keep up with the times and caused a very notable increase in identity theft since the introduction of the internet. It now became easier and more inconspicuous to gather this information from others. They were able to target a larger audience now that there were no geographical barriers. Viruses, malware, hacking, along with other unauthorized methods are commonly used.

How to protect your business from identity fraud

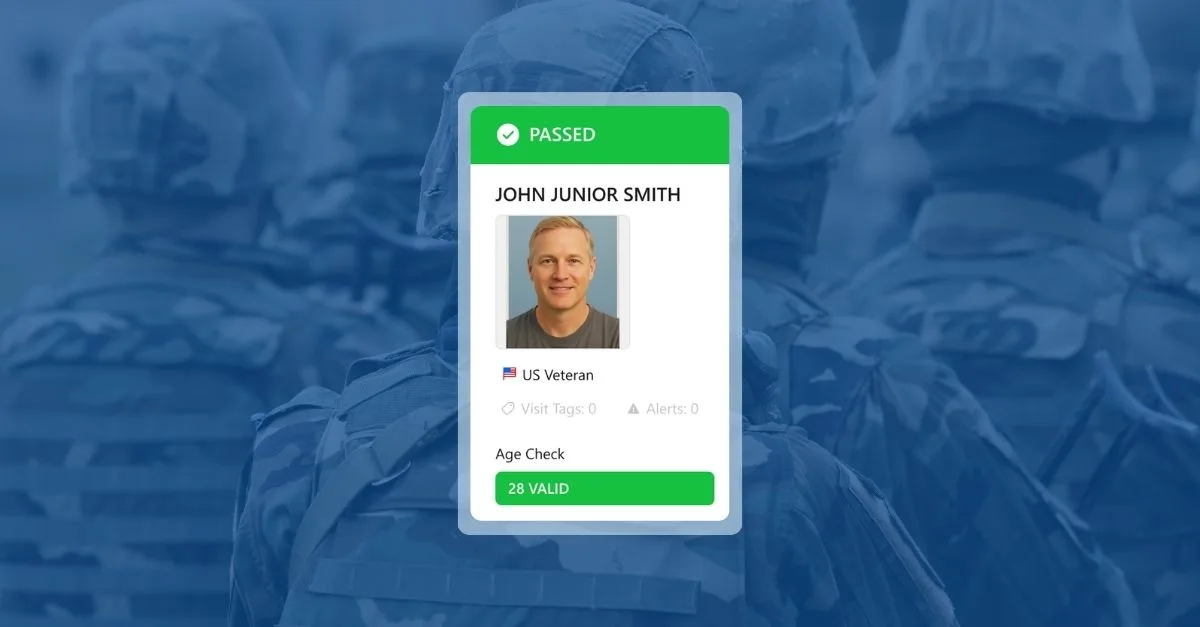

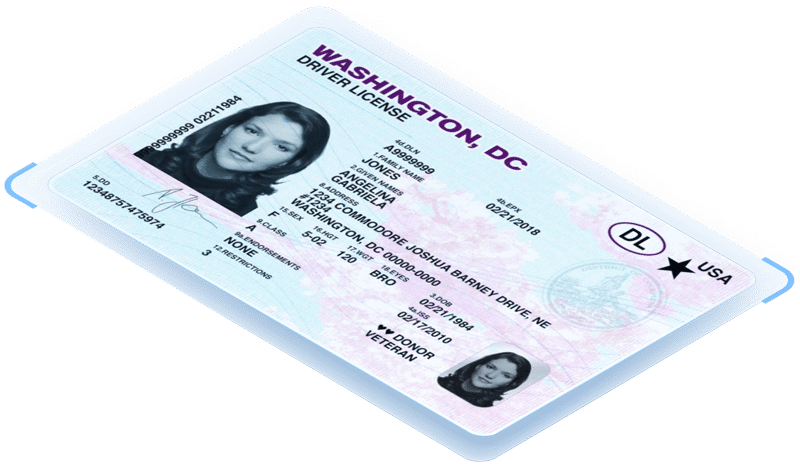

Businesses must be aware that identity theft is likely and that strong protections should be in place. Verifying and re-verifying identity is an integral part of fraud prevention and maintaining cybersecurity and IDScan.net has the solution to make it happen. Our mobile ID validation system can quickly and simply verify identity, leaving your customers with a streamlined and headache-free experience on your site or app. It’s also easily integrated into your current systems so you don’t have to stress about rehauling your setup.

To use our fraud prevention method, the customer simply takes 3 images with their smartphone:

- Front of the ID

- Back of the ID and

- A selfie

The automation performs mobile ID verification by checking that the ID is formatted correctly on the front and back. It also checks that the information in the barcode matches what is displayed on the front of the ID. It then queries the USPS database to confirm that the address on the ID exists. Lastly, it moves to the pictures, calculating a confidence percentage in facial match between the photo on the ID and the selfie supplied by the customer. The selfie is run through anti-spoofing processes to assure it is legitimate.

The customer’s picture is first compared to a database of known faces to ensure that a human face is indeed pictured. A complex algorithm then maps the customer’s face and compares the unique layout of the pictured face to the face on the ID provided. The mobile ID verification automation can then see more definitively whether or not the faces match and provide a percentage to represent the confidence it has in the faces being the same. Additionally, our DIVE API can verify most identification documents including driver’s licenses, passports, passport cards, green cards, and international documents with an MRZ (Machine Readable Zone).