Last updated on August 21st, 2024 at 01:04 pm

What is synthetic identity fraud?

Synthetic identity fraud is a type of fraud where criminals create a new identity by combining real and fake information to open new accounts, obtain loans, or engage in other fraudulent activities. Here are some of the most shocking statistics related to synthetic identity fraud:

- According to a study by the Federal Reserve, this type of identity fraud is the fastest-growing type of financial crime in the United States. It accounted for $6 billion in losses in 2016 and is projected to reach $8 billion by 2020.

- A more recent study done by Javelin Strategy & Research found that an astonishing $43 billion was lost in 2022 due to identity fraud. Which was an improvement from the year before which had $52 billion in losses.

- A report by the Aite Group estimated that this type of identity fraud accounts for up to 20% of credit losses and up to 85% of all credit card fraud losses.

- The same report also estimated that synthetic identity fraud affects up to 5% of all new account openings and up to 20% of credit applicants.

- The average loss per synthetic identity fraud incident is much higher than for other types of fraud. According to the Identity Theft Resource Center, the average loss per incident for this identity fraud was $15,000 in 2019, compared to $1,050 for credit card fraud and $4,400 for all types of identity theft.

This type of identity fraud is often not detected until months or even years after the fraudsters have started using the synthetic identity. This is because the fraudsters build up the synthetic identity’s creditworthiness over time by making small purchases and paying them off on time.

These stats highlight the severity of synthetic identity fraud and the urgent need for businesses and individuals to take proactive measures to protect themselves against it.

Where does the majority of synthetic identity fraud come from

The sources of synthetic identity fraud are diverse and can come from different channels. However, there are a few common sources that are often associated with synthetic identity fraud.

- The Dark Web: The Dark Web is a hidden part of the internet where illegal activities take place, including the buying and selling of personal information. Fraudsters can purchase stolen Social Security numbers, dates of birth, and other personally identifiable information on the Dark Web and use them to create synthetic identities.

- Data breaches: Data breaches are another common source of personal information used for synthetic identity fraud. When a company suffers a data breach, the stolen information can be used to create synthetic identities.

- Children’s Social Security numbers: Children’s Social Security numbers are often targeted by fraudsters because they have clean credit histories and are unlikely to be monitored for fraudulent activity. Fraudsters can use a child’s Social Security number and combine it with fake information to create a synthetic identity.

- AI technology: Fraudsters can also create synthetic identities from scratch using a combination of real and AI-generated information.

Synthetic identity fraud can come from multiple sources and fraudsters are continually finding new ways to obtain personal information. Businesses need to stay vigilant and adopt effective fraud prevention measures to protect against this growing threat.

Traditional techniques for protecting against synthetic identity fraud

Some of the techniques businesses have used to protect against synthetic identity fraud include:

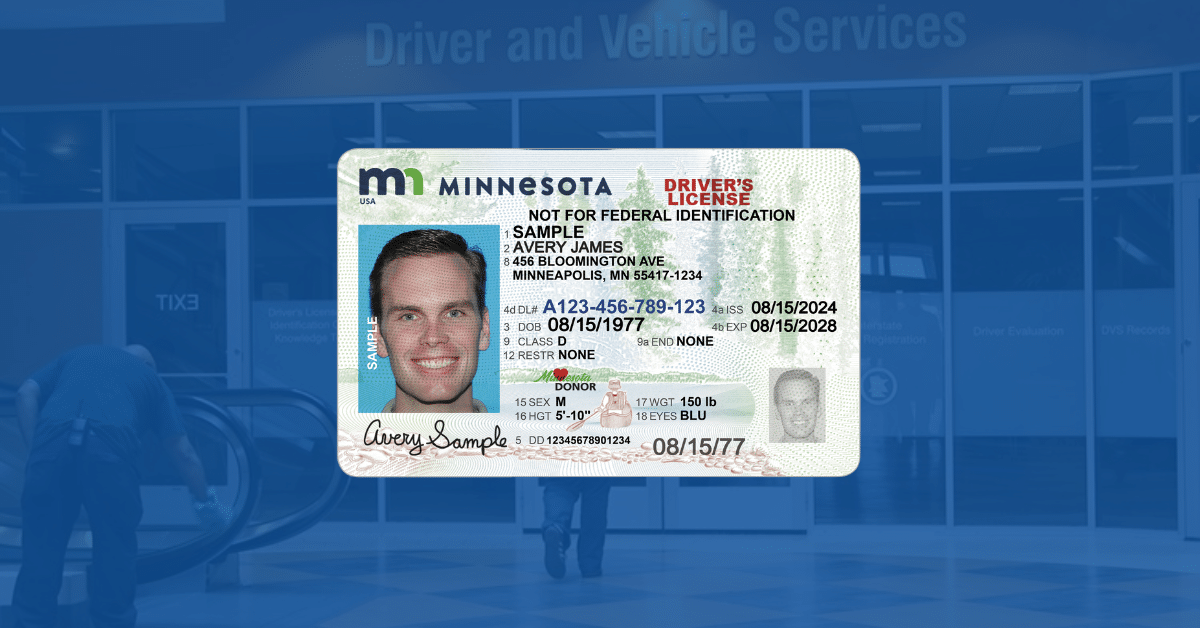

- Verifying identities in person: Businesses would verify the identity of customers by checking government-issued IDs, such as driver’s licenses, passports, or national identification cards. This would help ensure that the person applying for credit or opening an account is who they claim to be.

- Checking credit history: Businesses would check the credit history of applicants to verify their creditworthiness and identify any inconsistencies or red flags in their credit history.

- Manual underwriting: Businesses would manually review and underwrite credit applications instead of relying solely on automated systems. This would allow underwriters to detect any suspicious activity or inconsistencies in the application.

- Cross-checking information: Businesses would cross-check the information provided by applicants against other databases and records to ensure that the information is accurate and consistent.

- Conducting in-person interviews: Businesses would conduct in-person interviews with applicants to verify their identity and assess their creditworthiness.

While some of these methods are still used today, they have limitations and may not all be effective in detecting synthetic identity fraud. Fraudsters can use a combination of real and fake information to create a synthetic identity that may pass traditional identity verification methods. Therefore, businesses are increasingly turning to new and innovative approaches, such as artificial intelligence to detect and prevent this type of identity fraud.

Modern methods to protect against synthetic identity fraud

- Artificial Intelligence (AI): This technology is used to analyze vast amounts of data and detect patterns that may indicate synthetic identity fraud. By AI algorithms, businesses can quickly and accurately detect suspicious activity and prevent fraud.

- Behavioral analytics: Behavioral analytics involves analyzing user behavior to detect anomalies and unusual patterns of activity. This approach can help detect this type of identity fraud, as fraudsters often exhibit different behavioral patterns than legitimate users.

- Biometric authentication: Biometric authentication uses unique physical or behavioral characteristics, such as fingerprints, facial recognition, or voice recognition, to verify a user’s identity. This method is difficult to replicate and can prevent this method of identity fraud.

- Device fingerprinting: Device fingerprinting involves analyzing the characteristics of the device used to access an application or service, such as the device’s IP address, location, or browser settings. By analyzing this data, businesses can detect whether a user is using a synthetic identity.

- Third Party Checks: One of the tried-and-true methods of protection that has maintained its reliability is third party database checks. These checks run collected information against known databases such as the DMV, sex offender registry, IdentiFraud, and more. Collaboration with these third party databases involves sharing information across businesses and industries to identify and prevent identity fraud. By cross-checking information, businesses can identify patterns and trends in synthetic identity fraud and develop more effective prevention strategies.

These cutting-edge fraud prevention methods leverage advanced technology and analytics to detect and prevent synthetic identity fraud in real time. As synthetic identity fraud continues to evolve, businesses will need to stay ahead of the curve and adopt new approaches to protect against this growing threat. For more information on how your business can implement these protections, be sure to contact a member of our team or schedule a demo to see it in action.