As regulations tighten and fraud risks increase, Know Your Customer (KYC) and identity verification have become essential. From banking and fintech to high-end equipment rentals and gaming, KYC tools protect businesses and customers across industries. While crucial to mitigating risks and protecting customers, these services come with operational costs. Many organizations now face a key decision: should they absorb KYC fees as a “cost of doing business” or pass them along to customers?

What is KYC and Why It’s Important

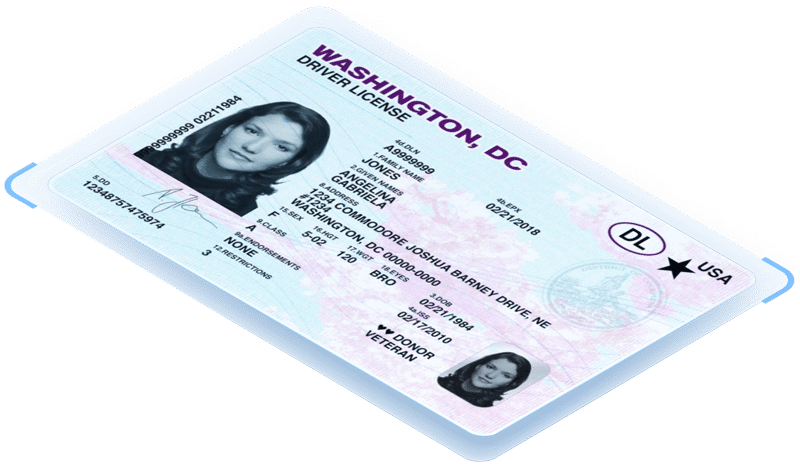

KYC (Know Your Customer) is the process businesses use to verify the identity of their customers before completing transactions or establishing relationships. It plays a vital role in basic fraud prevention.

Typical KYC processes include:

- Identity verification using government-issued IDs

- Document authentication to detect tampering

- Biometric and liveness checks to confirm real users

- Ongoing monitoring for suspicious behavior

Strong KYC procedures protect companies from regulatory penalties, reputational harm, and criminal misuse, while assuring customers that their data and transactions are secure.

What Drives KYC and Identity Verification Costs

Implementing KYC can be expensive, especially for high-volume businesses. Key cost drivers include:

- Document verification and authentication fees, sometimes charged per scan or as part of a tiered subscription

- API call costs to third-party verification providers (these can be ongoing if reverification is required)

- Data storage and compliance expenses to meet regulatory requirements

- Fraud monitoring and audit trail maintenance

Together, these costs can scale rapidly if your user base and transaction volume grow, meaning KYC can become one of the more significant compliance expenses. While each individual transaction is inexpensive, in aggregate, they can become burdensome.

Industry Variations in Handling KYC Costs

How businesses handle identity verification fees varies by industry. In regulated sectors like banking or lending, KYC is typically absorbed as part of doing business. But in transactional or one-time services, such as car rentals or equipment rentals, or in high volume consumer transactions, it’s common to pass along a small fee.

- The United States Post Office passes along a $1.10 identity verification fee to customers who are changing their address.

- Docusign has an optional identity verification fee, which document senders can pay to ensure the document signer is the intended individual with the rights to sign the document or contract.

- Some rental car agencies charge an identity verification fee for the customer’s first rental, which captures their identity and allows for checking against that same identity at a later date.

Many of these implementations generated significant internet chatter, but have remained in place despite consumer grumbling.

Pros and Cons of Passing KYC Costs to Customers

Passing along KYC costs offers clear advantages. It helps businesses recover recurring verification expenses, maintain transparency, and highlights their commitment to fraud prevention and compliance. It can also be a sustainable strategy for smaller or growing platforms with limited resources.

However, there are drawbacks. Extra fees can increase customer friction, reduce conversions, and damage brand perception, especially if competitors include verification as a standard feature. In tightly regulated industries, passing compliance costs may even attract regulatory scrutiny.

When Passing KYC Costs Makes Sense

Passing KYC and ID verification fees to customers can make sense in situations where transactions are:

- One-time or short-term, such as equipment rentals, or apartment tours

- High-risk or high-value, such as cryptocurrency exchanges or large asset purchases

- Selective, where only certain users require verification (e.g., vendors or guarantors)

- When your customer is a business and the verification is securing their assets

- When verification protects the customer or the asset such as high demand ticket purchases, or exclusive event access

- When the verification can easily be bundled into other fees such as an application fee or credit check fee

In these cases, customers are used to small service fees and are more likely to view them as reasonable and tied to safety.

When to Absorb KYC Costs

Businesses should absorb KYC costs when verification is essential to customer access, such as banks, lenders, and fintech companies. In price-sensitive industries like e-commerce or gig work, even small added fees can push customers toward competitors. Similarly, for long-term client relationships, covering verification costs can build loyalty and reduce onboarding friction.

How to Create a Fair and Transparent KYC Cost Strategy

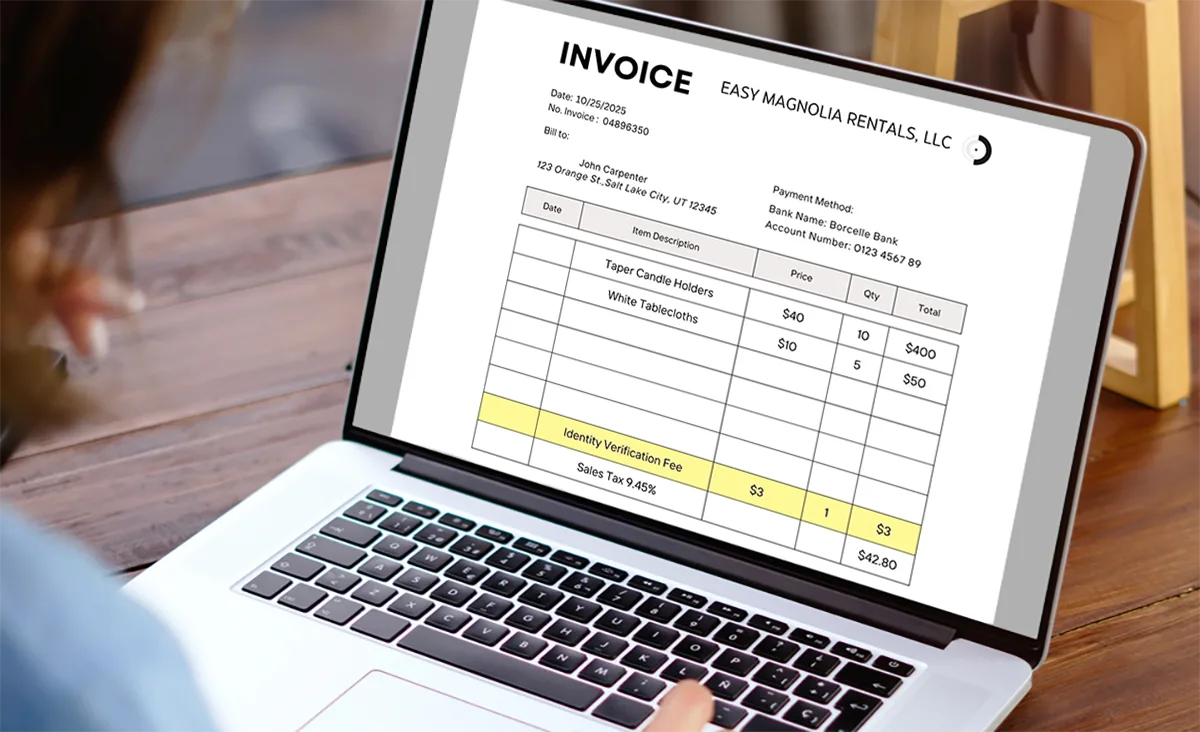

If you decide to pass along verification fees, the key is transparency and education.

- Clearly label the charge (e.g., “Identity Verification Fee – $3”)

- Explain that it helps protect against fraud and ensure compliance

- Offer verified users options to skip future fees

- Benchmark your approach against industry peers

- Consider bundling KYC into premium or tiered plans to add value

Transparent communication transforms a potential pain point into a trust-building opportunity.

Key Takeaway: Balance Trust, Transparency, and Profitability

Passing along KYC costs isn’t inherently right or wrong; it depends on your business model, customer expectations, and industry standards. The most effective strategies balance operational sustainability with a frictionless customer experience.

When handled transparently, identity verification can be positioned not as an expense, but as a value-added service that enhances safety, compliance, and trust. Whether absorbed or shared, KYC remains a cornerstone of responsible, secure digital business.