Everything you need to know about the state of fraud in cargo and logistics, and what you can do to prevent it.

The cargo and logistics industry faces an escalating fraud crisis. In 2025, fraud attempts reached record highs, with organized criminal networks exploiting vulnerabilities at every point in the supply chain. From distribution centers to loading docks, criminals armed with sophisticated fake identification are stealing high-value cargo, disrupting operations, and costing companies millions.

Fraud is concentrating in major logistics hubs, fraudsters are becoming more sophisticated, and the financial and reputational costs are accelerating. Drawing from over 1 million identity verification transactions, this report reveals the full scope of the threat, including where, when, and how ID fraud is happening.

It is more important than ever that companies implement robust ID verification systems to successfully prevent fraud before it results in losses. Proactive identity verification doesn’t just catch criminals, it can deter them entirely.

About this report

IDScan.net’s 2026 cargo and logistics ID fraud report was compiled from an analysis of over 1 million identity verification transactions across the industry. This report draws from ID verification transactions from logistics, warehousing, manufacturing, and transportation companies across North America.

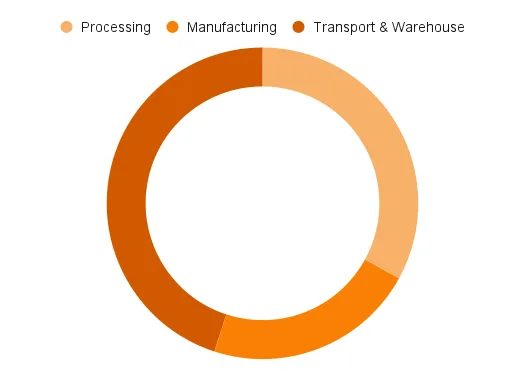

Respondent breakout by logistics sector

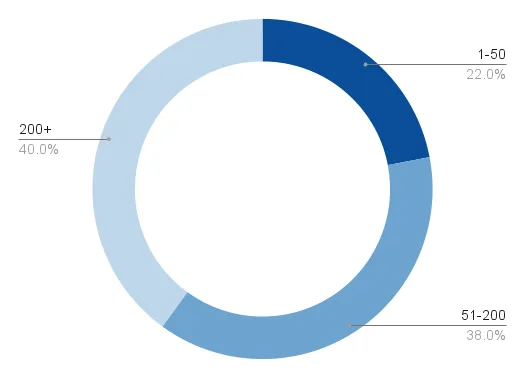

Respondent breakout by number of locations

Our analysis includes data from companies of all sizes and operational models, from single-facility operations to global corporations with hundreds of locations. This diversity provides insights applicable to organizations across the entire industry spectrum.

Key takeaways

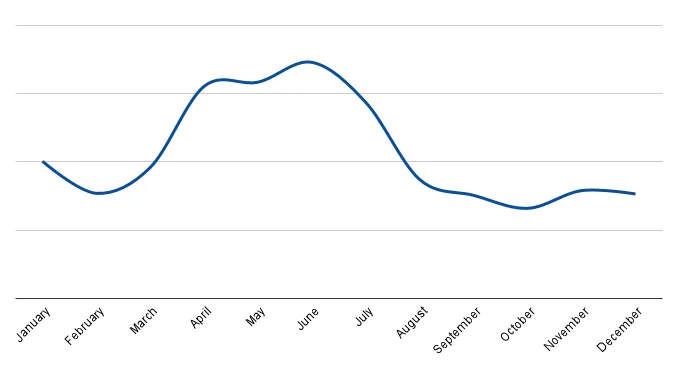

- Fraud rates hit an all-time high in 2025, with Q2 representing the worst quarter on record for fraudulent ID attempts in cargo and logistics operations.

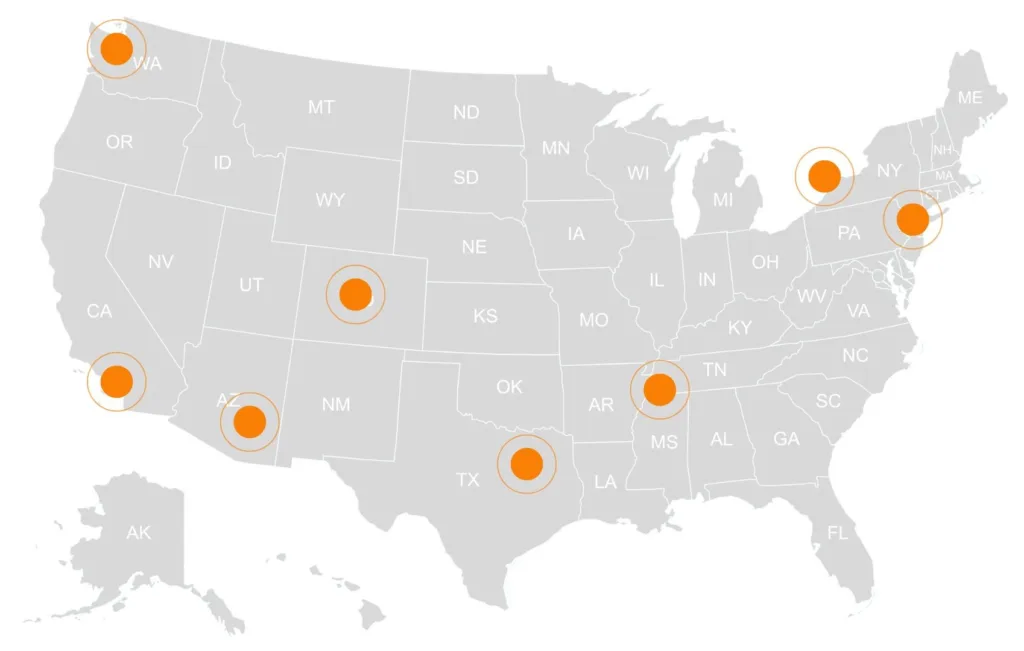

- Fraud is concentrating in major logistics hubs, with eight distinct hotspots accounting for a disproportionate share of fraudulent activity.

- The cost of fraud extends far beyond stolen cargo, impacting insurance premiums, customer relationships, regulatory compliance, and brand reputation in ways that compound over time.

- Prevention is non-negotiable. Companies using comprehensive ID verification systems successfully stopped tens of thousands of fraudulent attempts in 2025, preventing millions in potential losses.

Year-over-year ID fraud trends

ID fraud in cargo and logistics is accelerating. What once could be written off as isolated incidents has evolved into a systematic assault on supply chain security, with fraud rates steadily climbing.

increase from 2023 to 2024

increase from 2024 to 2025

ID fraud attempts increased 213% from 2023 to 2024, and rose another 30% from 2024 to 2025. This isn’t a fluctuation or random spike; it’s a sustained trend driven by organized criminal enterprises that have identified cargo theft as a lucrative, relatively low-risk operation.

The steady increase reflects several converging factors impacting the supply chain:

- E-commerce growth has multiplied the volume of high-value goods moving through supply chains.

- Driver shortages have created pressure to onboard workers quickly, sometimes at the expense of thorough verification.

- Criminal networks have become more sophisticated, with access to better fake ID technology and detailed intelligence about where security is weakest.

Shifting geographic patterns in supply chain and logistics fraud

New fraud hotspots emerged in 2025, adding to some of the major freight corridors where we’ve traditionally seen the most fraud attempts.

2025: A record-breaking year for logistics fraud

Fraud attempts during the second quarter of 2025 exceeded any previous quarter in our dataset, with rates climbing 75% over average.

The fraudster profile

Our data analysis reveals distinct patterns in fraudulent ID presentations and demographics that can help security personnel identify potential threats before cargo is compromised. These demographic patterns create a profile, but the critical insight is this: the typical fraudster doesn’t immediately raise red flags. They’re often middle-aged, male, presenting IDs from large states where such licenses are common.

The states appearing most frequently on fraudulent IDs are informed by a combination of factors, including where criminals obtain identity information, where they manufacture fake IDs, and which states’ security features they feel most confident replicating. In 2025, these states were:

- California

- Texas

- Georgia

- Florida

- Ohio

- Minnesota

- New York

- Illinois

- Washington

- Pennsylvania

The average age on fraudulent IDs presented in logistics fraud attempts is 46. This pattern makes sense for the logistics environment. A 46-year-old driver doesn’t raise suspicion at a warehouse or distribution center, while younger individuals might face more scrutiny, questions about their experience, or closer examination of credentials.

Average age on fraudulent IDs

More likely to be male

Fraudulent ID attempts are five times more likely to be male than female. This dramatic skew exceeds even the already male-dominated legitimate driver population in cargo and logistics, and likely reflects both the demographics of organized cargo theft rings and practical operational considerations.

These statistical patterns are useful for understanding fraud demographics, but shouldn’t translate into discriminatory verification practices based on age or gender.

Fraud hotspots

Eight metropolitan areas emerged as primary fraud hotspots in 2025, accounting for a disproportionate share of fraudulent ID attempts. These aren’t random locations; each is a critical node in North America’s logistics infrastructure.

2025’s ID fraud hotspots for logistics and supply chain businesses were:

- Los Angeles, CA

- Memphis, TN

- Dallas/Fort Worth, TX

- Toronto, Canada

- Seattle/Tacoma, WA

- Denver, CO

- Phoenix, AZ

- New York, NY

How ID fraud threatens operations and reputation

Direct losses: Stolen cargo and financial impact

The immediate cost of cargo theft is staggering. A single stolen truckload can exceed $500,000 in value, but direct cargo value is only the starting point. Companies face investigation costs as they work with law enforcement to document theft and attempt recovery. Insurance deductibles must be paid, and premiums rise after claims, creating ongoing financial impacts that persist long after the stolen cargo is written off.

Reputational damage

When criminals steal cargo using fake IDs at your facility, the consequences extend beyond your company. Your customers lose trust in your security and question whether their freight is safe. In the competitive logistics market, where reliability is paramount, this reputational damage can be fatal.

2025 cargo theft headlines

- $400,000 worth of lobster stolen en route to Costco stores

- Six men guilty in cargo theft ring that stole over $5M in electronics and merchandise

- Dozens of autographed Taylor Swift albums stolen from distribution center

- Man uses fake name to steal $100,000 shipment from DHL

ID fraud prevention for logistics

Companies implementing comprehensive verification systems are successfully stopping criminals before they access cargo, turning what would have been millions in losses into prevented attempts that never escalate beyond the gate.

Successful cargo theft prevention

In 2025, VeriScan stopped tens of thousands of fraudulent access attempts across the logistics industry. Each prevented theft represents not just the cargo value saved, but all the compound costs avoided: no investigation expenses, no insurance claims, no customer relationship damage, no regulatory scrutiny, no negative headlines.

AI-powered ID authentication

Real-time ID fraud detection ensures your facility stays secure. VeriScan instantly analyzes ID security features, including microprint, UV elements, holograms, and laser perforation patterns, and identifies tampering or alteration.

For enhanced security, third party checks can be added to check ID information against DMV databases or criminal background records.

Choose which IDs to accept

Not every valid ID should grant cargo access. VeriScan allows you to configure exactly which credential types your facility accepts. Many cargo operations set rules to accept only Commercial Driver’s Licenses (CDLs), automatically rejecting standard driver’s licenses regardless of authenticity.

You can also set geographic restrictions, age requirements, or other parameters specific to your operation. If your facility only works with regional carriers, you might accept CDLs from specific states. VeriScan enforces these rules automatically, eliminating human error or inconsistent application.

Deter criminals before the attempt

ID verification creates a deterrent effect. Criminals conduct reconnaissance, testing facilities to see where verification is rigorous and where it’s lax. When they encounter strong verification, they often move on to softer targets. Facilities known for consistent ID authentication see fewer fraud attempts over time.

Logistics and cargo trend predictions

Increasing fraud rates show no signs of reversing. Criminal networks are sophisticated, well-funded, and constantly adapting. The logistics industry will continue to be targeted because it represents opportunity: high-value cargo, multiple access points, and, in some cases, verification processes that haven’t kept pace with the threats.

Fraud rates will continue climbing

Unless the logistics industry makes significant, collective investments in prevention, cargo theft will continue. The factors driving fraud, including e-commerce growth, high cargo values, driver shortages, aren’t going away, and neither are the criminal organizations profiting from theft.

Technology arms race will intensify

As verification technology improves and is more widely used, fraudsters will attempt to defeat it. Fake ID quality will continue improving, and criminals will probe for weaknesses in specific verification systems and develop tactics to exploit them, making adaptive AI-powered solutions essential.

Geographic expansion will accelerate

As criminals face stronger verification in traditional hotspots, they’ll expand operations to regions they currently consider secondary or tertiary targets. Facilities that feel insulated because they’re not in areas like Southern California or Memphis should prepare for increased attention.

Organized networks will dominate

Opportunistic individual fraud is being displaced by coordinated operations with sophisticated intelligence, professional-quality fake IDs, and systematic targeting. The casual criminal can’t compete; the professional operations will control an increasing share of attempts.