Allegheny Casualty Company has provided innovative and advanced surety solutions since 1936. They had been using ID verification phone apps or visually inspecting IDs, but when they experienced increased fraud in 2023, they sought out a new identity verification solution.

The challenge: Increased broker and claimant fraud

Leaders at Allegheny Casualty Company wanted to efficiently and securely verify the identities of brokers and claimants to deter fraud. The common fraud tactics they were experiencing included:

- Fraudsters posing as freight brokers to apply for bonds, then using Allegheny’s bond to legitimize them to steal loads/funds from suppliers and truckers in the industries

- Fraudulent claimants filing false claims on bonds to receive payouts from Allegheny

The price tag on each fraud instance not only included the money lost but also required that they hire additional full-time employees solely to help mitigate this fraud.

The solution: Identity verification for fraud prevention

Allegheny Casualty Company chose to implement VeriScan’s digital identity verification platform in order to verify applicants and claimants.

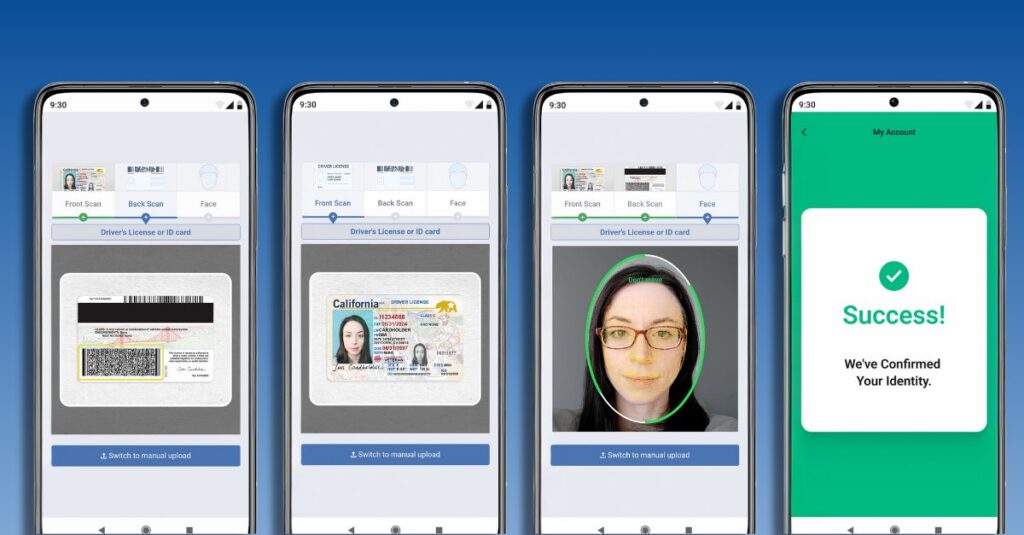

At the beginning of the underwriting process or a claims investigation, Allegheny triggers an identity verification request. This request is sent via text message and takes the user about 10 seconds to complete. The digital identity verification process:

- Verifies the ID document using hundreds of algorithmic checks

- Performs anti-spoofing and liveness checks to perform facial matching, ensuring the user matches the ID

How the VeriScan digital identity verification platform works

Here’s a snapshot of how the identity verification process works:

- The applicant or claimant receives a link via text

- The user is prompted to take photos of the front and back of their ID

- The user is prompted to take a live selfie video

- Results are returned within seconds

The outcome: Fraud prevention

Upon the implementation of IDScan.net’s remote identity verification solution, Allegheny Casualty Company has been able to successfully prevent fraud from taking place. They have found that many would-be fraudsters quit the process when they realize they must verify identity to submit.

In other instances, individuals’ identities have been flagged as fraudulent once they completed the process, empowering Allegheny to halt their processes before putting time and resources into underwriting or investigating claims.

VeriScan’s digital identity verification platform has prevented fraud, saving time, money, and Allegheny’s reputation.

About Allegheny Casualty Company

Allegheny Casualty Company is one the nation’s most unique and innovative sureties. Founded in 1936 as Allegheny Casualty and Mutual Company, Allegheny has a long history of partnership and collaboration with some of the oldest, most trusted and most experienced surety companies and leaders in the world. Allegheny brings an eclectic mix of experience, knowledge, and service to its growing family of agents and agencies all over the country. These attributes serve as the foundation that allows their team to be more creative, more nimble and more responsive to the needs of their agents.

About IDScan.net

IDScan.net offers the leading Adaptive AI identity verification platform focusing on ID fraud prevention, age verification, and access management for security and compliance. Across their suite of products, IDScan.net performs more than 18,000,000 ID and identity-related transactions monthly for more than 7,500 customers, including AMC Theatres, Circa Casino, MRI Software, Simmons Bank, Dutchie POS, Gamestop, Hertz, and more.