Last updated on October 16th, 2024 at 09:36 am

It will come as no surprise to those in the industry that financial fraud is still on the rise. The finance industry has always been a target for fraudsters, and as technology evolves, fraud tactics are evolving, too. These ever-changing, sophisticated fraud schemes led to a 13% increase in incidents in the past year, according to PYMNTS. With more than 7,500 global brands relying on IDScan.net’s ID scanning, identity verification, and ID fraud prevention technology, we know exactly how important it is to stay aware of fraud trends in order to combat them. We’ve gathered the data below to help keep you informed of current risks and how you can get ahead of them to keep your customers and business safe.

Consumers are concerned

88% of consumers prefer to do their banking online – as consumer habits trend increasingly to favor digital transactions, it’s essential that financial institutions develop offerings that meet this customer need. But as financial transactions expand their digital offerings, they are paving the way for more sophisticated methods of fraud.

While consumers are pushing financial institutions to adopt and expand digital capabilities, they are also growing increasingly concerned about fraud. Consumers lost almost $8.8 billion to fraud in 2022, more than 30% more than in 2021, according to FTC data. These losses have raised consumer fear, and that affects how they choose their financial institution – 72% of consumers agree that fraud is one of their biggest concerns, and 67% of consumers who experience fraud will switch their financial institution as a result.

Only 51% of consumers believe that financial providers are doing enough to protect against fraud and security risk. Financial institutions must bolster their fraud prevention efforts to ensure their customers feel safe.

The need for speed

We are in an age of instant gratification. According to FICO, 24% of American consumers will abandon opening a checking account if the identity checks are too time-consuming or difficult. For 70% of customers, the expectation is that opening a checking account will take less than 30 minutes.

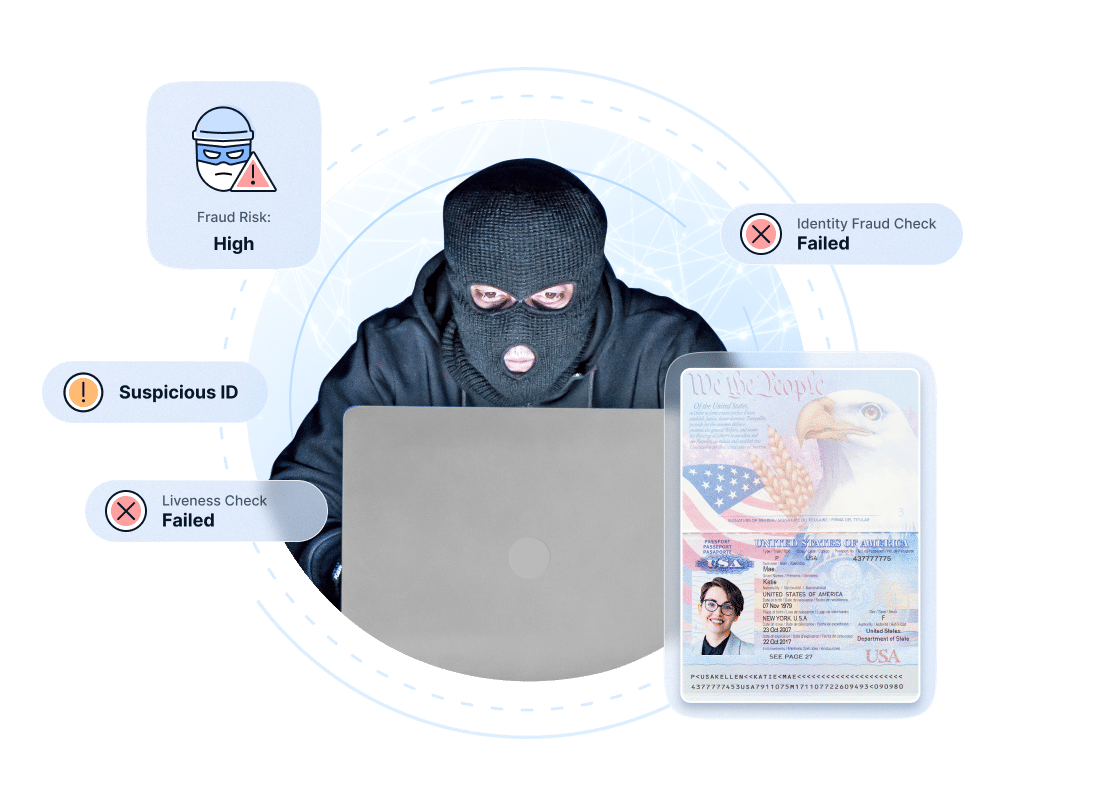

Financial institutions must implement tools that are secure without forfeiting efficient customer experience – obviously a difficult balance to strike. Digital identity verification platforms like IDScan.net’s DIVE have managed to strike this balance, where identity checks take 10-12 seconds on average and include essential fraud prevention methods, like barcode security checks, face match selfies with anti-spoofing and liveness checks, and front/back information matching.

Current risk trends and solutions

We’ve aggregated some of the most recent data on fraud within the financial industry and recommendations for methods to prevent your financial institution from falling victim. Staying aware of current fraud trends, and the evolving tools to combat them, is essential to keeping your customers and assets safe.

FinTech fraud

Fraud doesn’t just lose assets that are directly stolen, 34% of FinTechs lost customers over fraud in 2023, according to PYMNTS. Smaller financial firms are at the greatest risk for fraud, with an average loss of 2.2% of revenue. While larger firms are slightly less affected, fraud still accounts for a 1.4% revenue loss.

Deepfake technology’s influence on digital financial fraud

The Problem: Deepfake fraud is skyrocketing, rising by 3,000% in the US from 2022 to 2023.

Deepfake fraud is committed by impersonating real individuals or creating completely new identities, most often through voice and video, and the financial industry is a primary target. While one-third of global businesses have been hit by deepfake fraud, about half of companies in the banking sector experienced deepfake fraud attempts, reports show. Deepfake fraud is used for a myriad of trending fraud methods, including identity fraud, synthetic identity fraud, and account takeovers.

The solution: AI-powered security, digital identity verification, and third party checks

Identity fraud

The Problem: 12.3% of respondents to a FICO survey said that their identity has been used to open a financial account, and 32% ranked having their identity used to open an account as their number one financial fraud concern. Consumers have reason to be concerned about identity fraud; rates in the FinTech sector rose 73% between 2021 and 2023 as fraudsters have rapidly adopted new fraud methods to circumvent existing security measures.

The solution: Secure digital identity verification

Account takeovers

The Problem: Fraudsters are quickly finding new ways to access customer accounts as financial institutions increasingly rely on biometric identity verification, such as face ID, for account access. While multi-factor authentication (MFA) was enough at one point to deter fraud, deepfake technology is now being used to mimic biometric data to circumvent MFA and gain account access.

Once the fraudster has access to the account, they can not only access anything that was previously protected but can also change contact information and passwords to ensure the account owner is locked out for an extended period. This is becoming an extremely popular form of fraud, with deepfake “face swap” attacks on remote identity verification increasing by 704% in 2023, according to SC Media

The solution: Secure digital identity verification

Synthetic identity fraud

The Problem: While synthetic identity fraud isn’t a new issue for financial institutions, the tactics used to commit this type of fraud have rapidly changed. Personal information is more widely available to criminals than ever, with data breaches increasing by 83% over the past two years. Meanwhile, deepfake technology has made synthetic identities more believable – not only are fraudsters using stolen personal information to create these fabricated identities, they are creating images, videos, and audios to circumvent rudimentary identity verification. It’s estimated that synthetic fraud costs banks at least $6 billion annually.

Due to the rise in synthetic identity fraud, steps have been taken by the Federal Reserve Bank to define this type of fraud. By defining synthetic identity fraud as “the use of a combination of personal identity information (PII) data to fabricate a person or entity in order to commit a dishonest act for personal or financial gain,” financial institutions are able to more accurately track the losses. This increased visibility into synthetic identity fraud will improve loss prevention strategies.

The solution: AI-powered security and third party checks

Brick-and-mortar financial fraud

While consumers are increasingly relying on digital financial solutions, a recent FICO report found that 65% of customers still find value in the information and services available at brick-and-mortar banks.

Deepfake technology’s influence on in-person banking fraud

The Problem: Deepfake technology is being used to make more realistic fraudulent IDs. These fake IDs either use a completely fabricated identity or stolen personal information from a real person to create documents that are much less clearly fraudulent than the fake IDs of the past. These fake IDs can be used to open accounts, take out loans, make withdrawals, and cash checks.

The solution: ID authentication and third party checks

Fraud prevention tools and tactics

Unfortunately for financial institutions, the complexity of fraud tactics means fraud prevention must be a multi-pronged approach that is consistently evaluated and updated. Below are some of the most effective current fraud prevention tools that should be utilized to protect customer information and prevent loss.

AI-powered security to combat AI-powered fraud

It may seem counterintuitive that the technology used to create deepfakes could be a solution for detecting it, but because AI has so many capabilities, it is often the most reliable way to prevent deepfake fraud. As the technology to create deepfakes improves, so does the technology to safeguard against it. Financial institutions that are using AI fraud prevention tools experience a decrease in their overall fraud rates, according to recent studies.

AI and machine learning fraud prevention tools are trained in anomaly detection and pattern recognition, meaning they can efficiently spot signs of fraud that may otherwise go unnoticed. These tools are also capable of continuously learning when updated with new datasets to improve fraud detection and catch new signs of fraud as they emerge. Older forms of fraud detection that rely on humans are exponentially less effective and slower to evolve when compared to AI fraud detection methods.

Secure digital identity verification

Facial matching technology is a common step for remote identity verification but can have vulnerabilities to fraud if the tool being used does not utilize robust anti-fraud measures.

While facial matching checks to see if biometric data, generally the user’s facial features, matches the identity on file or provided in the form of an ID, liveness detection uses algorithms to determine if the face being presented belongs to a live person as opposed to a picture or video. Anti-spoofing measures add an extra layer of security – since more sophisticated deepfake technology is able to mimic some of the basic liveness checks, anti-spoofing technology aids in determining if the user is a living person or a fraudulent representation.

Document liveness is also growing in necessity, as it eliminates the ability for fraudsters to use images of IDs (including AI-generated fake ID images) in place of a physical document they have in their possession.

Financial institutions that rely on facial matching technology must use software that includes liveness detection and anti-spoofing measures to effectively defend against fraud.

ID authentication

ID authentication is a process that combines AI-powered software and specialty hardware capable of multi-light scanning to detect fraudulent IDs so that they cannot be used for criminal activity. True ID authentication solutions are capable of catching 95% of fake IDs by performing hundreds of algorithmic checks, using high-resolution cameras to examine holograms and watermarks, and front/back matching which ensures the data on the front of the ID matches the information stored in the barcode.

Third party checks

Third party identity checks compare provided information against third-party databases, such as USPS address records, DMV databases, and Social Security Administration records. This allows for ID information to be verified against a variety of databases, adding a layer of identity proofing that is especially helpful in preventing synthetic identity fraud.

Staying informed of risks and trends

Businesses at risk of deepfake fraud should educate their employees and customers on how to detect and prevent this type of fraud and stay informed about deepfake fraud trends to catch criminal activity quickly.

Knowing about fraud trends and effective prevention tools helps financial institutions keep their customers and assets safe. If you are interested in learning more about how AI-powered ID authentication can help keep your business safe, reach out to one of our identity experts.