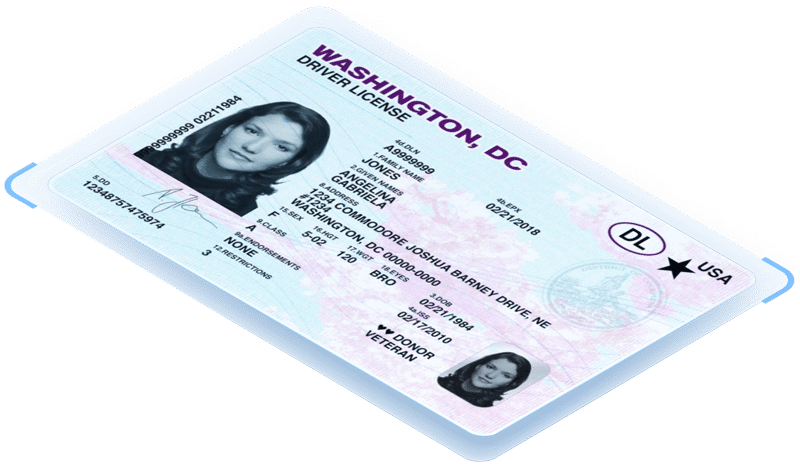

Mobile driver’s licenses (mDLs) are quickly becoming a standard form of identification in the U.S. As of today, they’re fully active in 19 states and Puerto Rico, with six more states preparing to launch by the end of 2025. Depending on the state, mDLs can be stored in Apple Wallet, Google Wallet, Samsung Wallet, Idemia apps, or standalone state apps.

mDLs serve as a supplement to physical IDs, not a replacement. While digital IDs are generally more secure than a physical card, for both businesses verifying them and cardholders, it is still essential for businesses to be aware of potential fraud tactics.

Why digital IDs are challenging to fake

Reduced risk of theft or loss

Unlike a physical driver’s license that can be lost or stolen, an mDL is protected by device-level security like a PIN, fingerprint, or FaceID. Even if a phone is stolen, the owner’s digital ID would be difficult to access without knowing the owner’s password or having access to their biometric data. Additionally, mDLs can be remotely deactivated, shutting off access immediately if the phone is stolen.

Backed by ISO standards

ISO standards create a security framework for mDLs, defining technical specifications, security protocols, and privacy protections. These standards are updated regularly to stay ahead of fraud tactics.

Advanced verification methods

Every active mDL includes verification technologies such as a QR code, NFC, and/or Bluetooth. These features add layers of security that make creating fake digital IDs extremely difficult.

How mDL verification works

Interactive security features

Many mDLs have interactive features to improve security for businesses verifying by visual inspection. Louisiana’s mobile ID shows an image of the state seal when tapped to ensure screenshots or images aren’t used. However, more advanced fraudsters have methods of replicating these interactive measures, so visual inspection alone should not be relied upon to verify the legitimacy of an mDL.

QR code

QR codes are a more secure verification method. When scanned, mDL verification software can run a real-time validity check to confirm the QR code is tied to a legitimate ID. The QR codes present on these identity documents are dynamic, meaning they update and change, ensuring a screenshot of the code will not be verified.

NFC (Near Field Communication)

NFC is the same secure technology behind Apple Pay and Google Pay. It’s considered tamper-proof and enables quick, encrypted transfers of ID data. With an NFC-capable ID scanner or smartphone, businesses can confirm legitimacy on the spot.

Bluetooth

Bluetooth verification is similar to NFC, where businesses can use a smartphone or ID scanner with Bluetooth capabilities, combined with ID verification software, to verify digital IDs. Bluetooth data transfers are secure and encrypted to keep ID data safe while verifying legitimacy.

PDF417 Barcodes

Just like on a physical ID, the Louisiana mDLs include a PDF417 barcode. Businesses already using barcode scanners for age or ID checks can scan these easily. However, because these barcodes are present on all physical IDs, some fraudsters have sophisticated methods of replicating them, which makes relying on barcode scanning alone risky.

Digital ID security weaknesses

Despite their security, mDLs aren’t bulletproof. Fraud is still possible if verification technology isn’t used. If a business is relying solely on visual inspection, a fraudster could present a screenshot or a fake app designed to mimic a real mDL.

Fabricated mDL apps have already been seen in Australia, where fraudsters created counterfeit apps. Some states have even removed easily faked holograms from their mDL apps in response, and state authorities have released recommendations for verification methods to ensure digital IDs are legitimate.

Without mDL verification solutions, businesses could fall victim to fraudulent IDs.

Recommendations for verifying digital IDs

Digital IDs are far more secure than their plastic counterparts, thanks to biometric protections, ISO standards, and technologies like QR codes and NFC. But fraudsters are persistent. The biggest vulnerability lies not in the technology itself, but in businesses relying solely on visual checks instead of proper verification tools.

As mDL adoption grows across the U.S., it’s critical for businesses to invest in ID scanning and verification software. This ensures they can spot fakes, avoid fraud, and keep trust in digital IDs strong.