Fraud has become one of the fastest-growing threats facing financial institutions today. From synthetic identity fraud and phishing to card-not-present schemes, criminals are growing more sophisticated, and so must the systems designed to stop them. Yet as banks and credit unions adopt new tools to mitigate fraud risk, they face a delicate balancing act: how to introduce security without undermining the trusted, human relationships they’ve worked so hard to build.

At Agent IQ, we believe fraud prevention and relationship banking don’t need to be at odds. In fact, we’ve built our Adaptive AI digital engagement platform, Lynq®, to support both. By combining advanced verification tools with flexible engagement options, we help institutions tailor their security to each account holder interaction. This creates safer, smarter, and more personal experiences across every channel.

Here’s how our latest capabilities are making a difference.

Seamless ID verification powered by IDScan.net

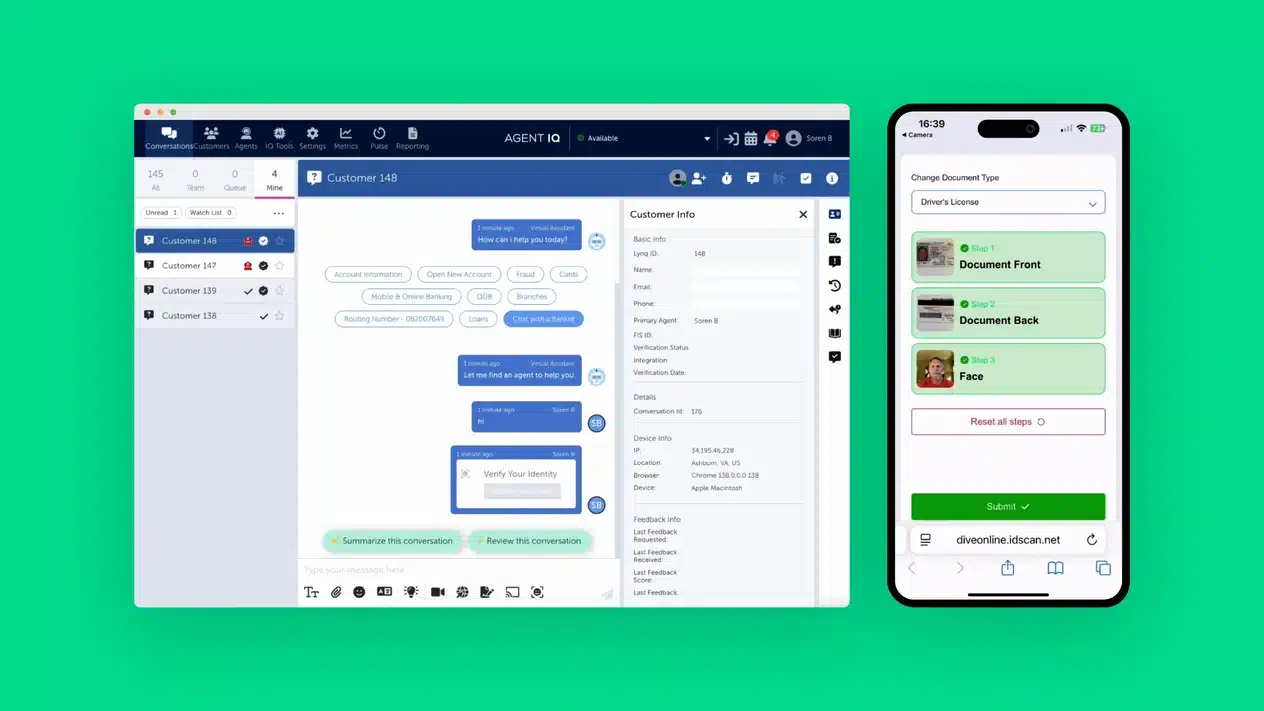

We recently partnered with IDScan.net, a leader in ID scanning and ID fraud prevention software, to bring their digital identity verification (DIVE) technology directly into the Lynq platform.

Read more on Agent IQ.