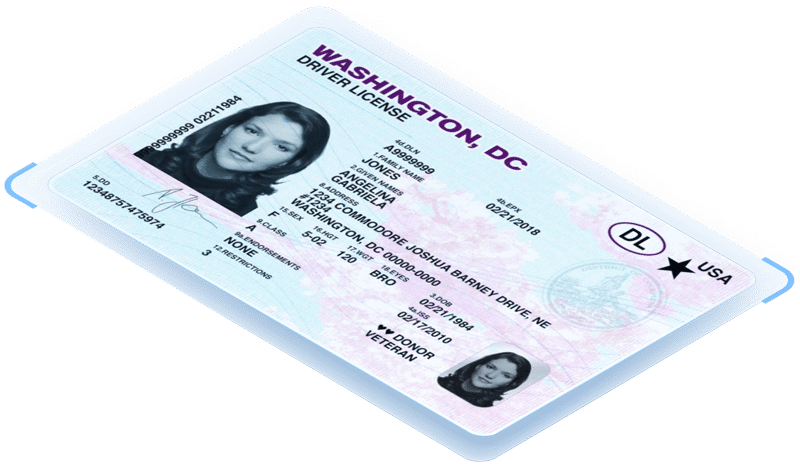

17 US states currently offer mobile drivers licenses (mDLs), with five more set to release in 2025, so it’s no surprise that businesses are eager to know when they can start accepting and verifying these digital credentials for online transactions.

mDLs are currently accepted by the TSA, law enforcement, and at polls for elections, in addition to bars, restaurants, and other businesses that verify age. While brick-and-mortar businesses can verify mDLs today, the digital verification process is still a work in progress.

Why can businesses verify mDLs in person but not digitally?

At first glance, you might think verifying an mDL online would be as easy as checking it in person, especially given the digital IDs are already on users’ smartphones. However, the issue lies in the fact that each state has the autonomy to develop its own mDL.

This means that states can use proprietary apps, like Louisiana’s LA Wallet, or offer their mDLs directly through Apple Wallet or Google Wallet. With so many different platforms and formats in play, creating a unified system for digital verification is a major challenge.

Right now, there are no universal standards for how mDLs should communicate with digital verification solutions. This lack of consistency makes it difficult to ensure that an online verification process is both secure and reliable.

Currently, for in-person mDL verification, an API is used to request access to the user’s digital wallet. The OPENID4VP specs provide the details on how to use the Digital Credentials API to ask for access to the wallet and request pieces of data that the mDL can provide.

Standardization: The path to digital mDL verification

Standards are currently being developed to allow digital verification of mDLs. The International Organization for Standardization (ISO) has set guidelines for in-person mDL verification, ISO 18013-5, which have been in place since 2021. However, similar standards for digital credentials are still in development.

ISO has released drafts of the proposed standards to guide developers and gather feedback which will ultimately shape the final standard for digital mDL verification. This is a significant step toward enabling secure and standardized online identity verification across all platforms.

Additionally, the World Wide Web Consortium (W3C) is working on a Digital Credentials API standard, which will define how mobile browsers can access credentials stored in digital wallets like Google Wallet. While Google has a public beta of this standard, we have yet to see widespread support from other major players, such as Apple or Samsung.

Another challenge lies with the American Association of Motor Vehicle Administrators (AAMVA), which maintains a verifier list for mDLs in North America. Currently, the verifier list is only available through a manual download or an undocumented API, creating hurdles for businesses trying to implement mDL verification solutions.

When will businesses be able to verify mDLs digitally?

The good news is that the ISO standards for mDLs are progressing, but it will take time for mDL developers to implement these new guidelines. Once the standards are finalized, we can expect a wave of updates across mobile wallet apps to ensure compliance. However, it could still take some time before all mDLs can be universally verified online.

On a more promising note, California has announced a public beta of their remote verification program, which is expected to be widely available by Q1 2025. This could be a significant milestone, providing a glimpse of what mDL verification will look like on a broader scale in the future.

How can businesses verify mDLs right now?

If your business is looking to verify and accept mDLs in person today, there are multiple options available to help. VeriScan allows businesses to quickly and securely verify ID, whether customers have physical or digital IDs.

VeriScan for iOS allows businesses to verify mDLs directly from an iPhone, with no additional hardware needed, using NFC technology.

The Tap2ID Mobile ID Reader, paired with VeriScan software, allows businesses to verify mDLs from all live states, including those in Apple Wallet or Google wallet, using either the NFC or QR code capabilities.

While businesses may not yet be able to verify mDLs digitally for online transactions, these tools can help with in-person checks until the standards for digital verification are finalized and adopted.

Mobile driver’s licenses represent a significant leap forward in digital identity verification, offering a more secure and efficient way to validate customers’ identities. However, until universal standards are set, businesses will need to rely on in-person verification tools and wait for the digital verification systems to catch up. With developments underway, particularly in California, it’s clear that the future of digital mDL acceptance is on the horizon, and businesses will need to stay informed to be ready when the digital solution becomes available.