Every identity verification provider is reporting on it: identity fraud is on the rise. Increasingly accessible and sophisticated fraud tools, combined with the motivation of economic uncertainty, have made fraud more common and harder to detect.

Businesses must take action to fight against this wave of fraud before they fall victim to the financial losses and reputational damages of fraud.

What is ID fraud?

There are many types of fraud, but fraudulent identity credentials are central to many types of modern fraud and theft. Fake physical IDs can be purchased online with a simple Google search, and most are high-quality fakes that cannot be detected by visual inspection. Additionally, fake ID images, and deepfake images and videos, can be generated on darkweb sites. While these images aren’t helpful for in-person fraud, they can be used in digital identity verification processes that ingest and analyze ID images as part of their verification or onboarding process.

Fraudulent IDs (whether physical or digital) give fraudsters the legitimacy to pose as someone else or create a synthetic identity, allowing them to commit crimes, steal money, gain access to government benefits, scam others, and enrich themselves.

ID fraud is increasing due to economic uncertainty

While fraud is always a reality, there is a strong correlation between economic recessions and rising fraud. The Association of Certified Fraud Examiners found a direct correlation between economic downswings and increased fraudulent activity. A study, done in 2009 and analyzing the impact of the 2008 housing crisis showed that 55% of businesses reported an increase in fraud incidents between 2008 and 2009.

Although brief, the economic downtown associated with COVID-19 was also a ripe era for fraudsters. Businesses saw significant spikes in default/bust-out fraud using synthetic identities and fraudsters had a feeding frenzy scamming businesses, consumers, and the government itself to gain illegitimate access to relief funds.

As we look forward in 2025 and beyond, with some economists predicting economic stagnation or even contraction, businesses should remain vigilant of similar trends. In fact, we are already beginning to see worrisome trends that indicate fraud is already rising in response to economic uncertainty.

2025 ID fraud data

In an analysis of our finance and banking customers, we found that identity fraud in 2025 is already 34% higher than the same time period in 2024. Identity fraud against financial institutions typically spikes in the spring, as fraudsters try to intercept tax refunds. March 2024 showed an 37.6% increase in fraud volume, with April just behind March at 21.4% over annual averages. But 2025 looks to blow last year out of the water. If trends continue, March and April 2025 will see fraud that is 32.1% over the 12 month average, and up 33.7% year over year.

But financial institutions and banks are not the only businesses at risk. Across our portfolio of businesses we see trending ID and identity fraud in several verticals.

- Logistics & transportation – ID fraud is up 23.3% since December

- Retail and consumer goods – ID fraud is up 22.7% since December

- Automotive dealerships – ID fraud is up 20% since December

These increases have risen rather starkly in January 2025, correlating with stock market losses, large company layoffs, and government agency RIFs, so while they speak to an overall market increase in general fraud activity over time, the large spikes we’re seeing today appear linked to the very near-term economic outlook. Looking forward through the rest of 2025, we expect this trend to increase.

Committing ID fraud is easier than ever due to access to AI

In addition to an increased motivation to commit fraud, would-be fraudsters have a larger bevy of tools at their fingertips than ever before.

Websites such as OnlyFake allow users to generate images of fake IDs and passports. These sites allow users to input their desired fields (first name, last name, date of birth, ID number) and then create a highly realistic image of the ID in-situ. The ease of creating these documents prompted an FBI warning in December 2024, advising businesses to be careful of AI-generated images.

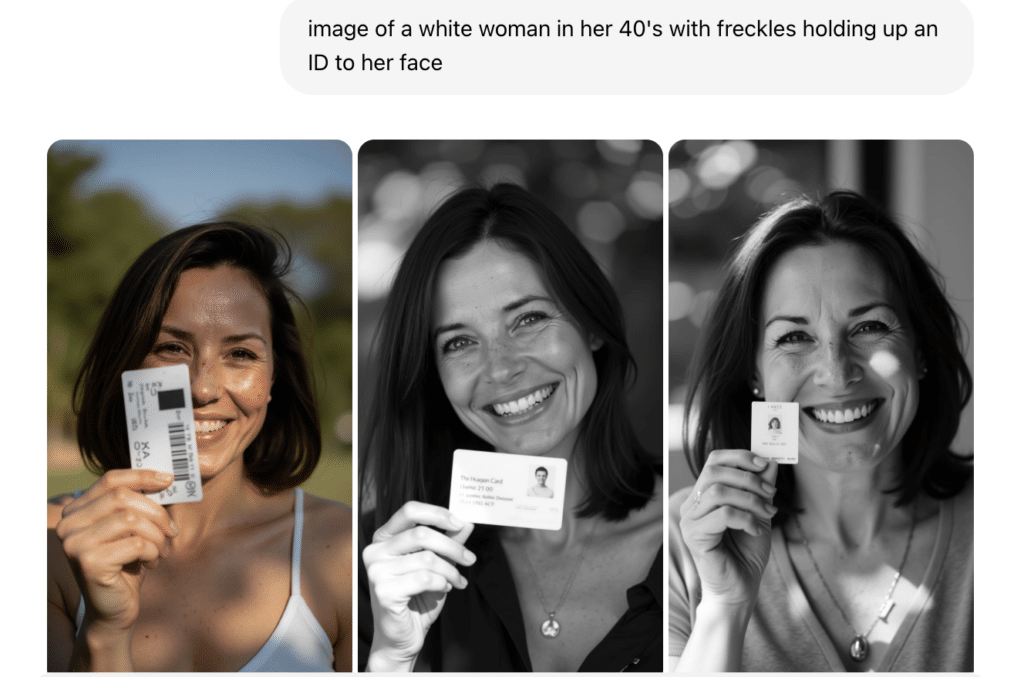

AI-generated faces can be made with the click of a button on sites such as ThisPersonDoesNotExist.

Tools like Krea.ai and MidJourney allow users to create images that blend visuals of the individual with the ID. These types of images are common for re-verification workflows for Uber, Facebook, etc. as they include both a visual of the individual (face) and the ID (document).

Used together, with a little bit of Photoshop and a few personal details, a synthetic identity can be created that is capable of fooling visual checks, and entry-level identity verification software. For the advanced fraudster, these tools can even be used to generate deepfake videos that can be used in liveness checks and counter anti-spoofing measures.

Secret Telegram channels are hubs for fraudsters and criminals to discuss techniques for blending this data, trading fullz, and discussing which identity verification providers are easiest to fool, and which companies use which provider. They know systemic weaknesses and readily share how to exploit them and which organizations are vulnerable.

In 2025, it is easier than ever to be a fraudster. Those with the motivation to seek alternative sources of income have fewer barriers than during past economic downturns with a rapidly expanding toolset.

A 2025 approach to fighting ID fraud

If trends continue, and the adverse relationship between the US stock market and fraud trends continue, we expect that fraud will increase an average of 5% for every additional 10% drop in the NASDAQ. We are also exploring correlations between fraud attempts and national unemployment, as individuals turn to nefarious sources in search of income. Businesses and organizations should steel themselves for increased attempts at fraud, an increasingly diverse fraudster demographic, and a larger span of fraud sophistication meaning businesses need safeguards in place for both rookie fraudsters using cobbled together tools, and veteran fraudsters who have more experience with deepfaking and more sophisticated attacks such as injection attacks.

SMB as a primary target for ID fraud

Although larger banks and enterprises always experience a larger volume of attacks, as they represent greater economic opportunities for a large “score,” fraudsters are increasing their attacks at smaller banks, credit unions, independent car dealerships, and main street businesses, as they are less likely to have dedicated fraud teams, expensive anti-fraud software, etc. Businesses who may have previously considered themselves low on the target list will increasingly become victims of fraud operations.

Liveness as a key element

AI-generated images are extremely easy to create and fake. While deepfake video tools do exist, they are less accessible to the newbie fraudster, and require more specialized tools. Economically motivated scammers will likely lean on the easier/cheaper image-based tools. Face liveness and document liveness should be table stakes as they eliminate the ability to use these fake ID images in digital processes. This is not a panacea, but it does combat a large percentage of fraud we see regularly.

Behavior-based risk signals

Behavior-based risk detection analyzes user behaviors, such as login patterns, device interactions, typing speeds, and navigation habits, to detect anomalies that might indicate fraudulent activity. By monitoring these behavioral traits in real time, organizations can identify suspicious activity much earlier than traditional methods, which primarily rely on static data like passwords or security questions. This proactive approach helps to prevent fraud before significant damage is done.

AI to fight AI

AI has empowered fraud tools to improve at exponential rates, making Adaptive AI fraud prevention solutions the only method of keeping up with these evolving tactics. AI uses machine learning to constantly and consistently improve to detect patterns or inconsistencies that may otherwise go unnoticed.

Our predictions for 2025 and beyond

As economic pressures mount in 2025, experts predict a surge in fake ID fraud as individuals seek new ways to bypass age restrictions, gain unauthorized access, or commit financial fraud. Inflation, job insecurity, and tightening credit markets may push more people toward identity fraud, with sophisticated fake IDs becoming more accessible through AI-driven forgery and the dark web. Businesses in sectors like retail, hospitality, and finance—where identity verification is critical—are likely to see increased attempts at deception, especially as fraudsters exploit outdated verification methods or gaps in digital security.

To combat this growing threat, businesses must adopt a multi-layered approach to identity verification. Advanced Adaptive AI ID scanning, biometric authentication, and real-time data cross-referencing can significantly reduce fraud risk. Training frontline employees to recognize fake IDs and implementing automated age-restricted access controls—such as smart ID scanners at self-checkouts or restricted product cabinets—can further prevent unauthorized transactions. Additionally, companies should stay informed about evolving fraud tactics and collaborate with industry groups and regulatory bodies to strengthen ID verification standards and enforcement.