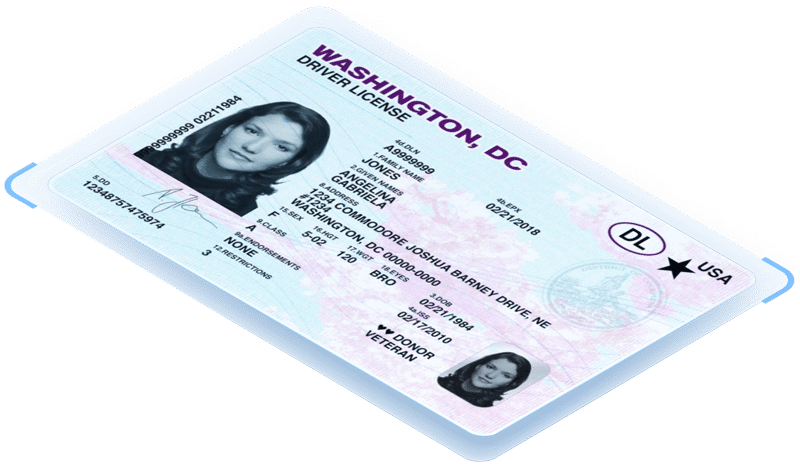

Banks and credit unions using MeridianLink can verify identities and feed accurate data into their LOS by using an E-Seek M500 scanner with IDScan.net’s ParseLink software. This provides a seamless experience for tellers and customers, preventing mistakes and protecting institutions from fraud that can occur with outdated manual ID checks.

Benefits of using MeridianLink with ParseLink authentication:

- Catch nearly 100% of fake IDs and prevent data from fraudulent identities being parsed into your system

- No more manual data entry, saving valuable manhours

- Eliminate typos and errors with ParseLink’s 100% accuracy data automation

- Increase enrollment with a more efficient process for staff and applicants

- Capture images automatically and eliminate the need to make photocopies

How to scan IDs into MeridianLink using an E-Seek M500 ID scanner

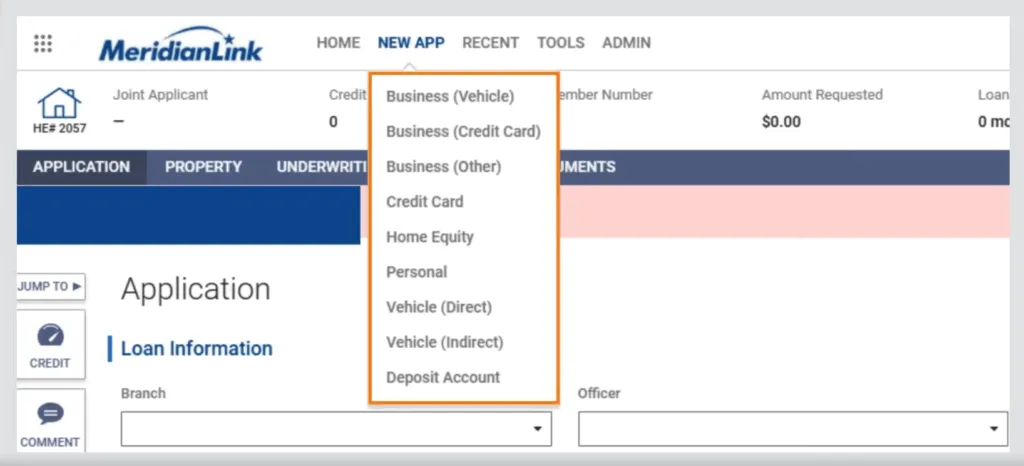

ParseLink’s integration works with all application types available. Begin the loan application as usual, entering any information not on the applicant’s ID.

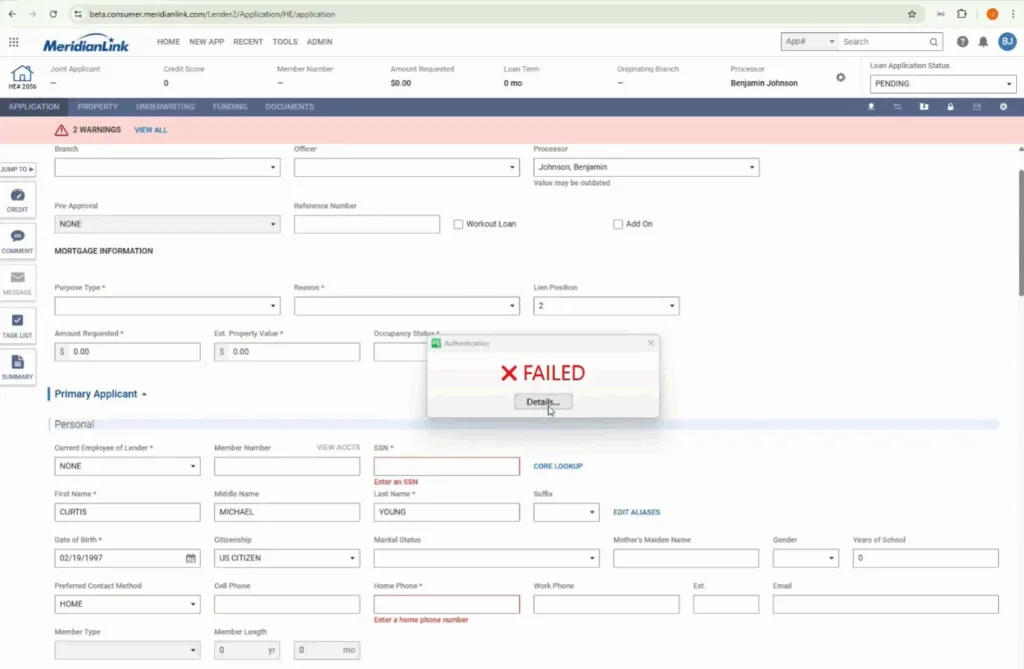

Once you reach the “First Name” field, simply scan the ID.

In just a few seconds, the ID data will populate into the respective fields, ensuring the data is free of errors or typos.

Then, the authentication result will appear. If the ID is flagged as fraudulent, the “Failed” pop-up will appear. Select “Details” to see more information.

ParseLink authentication runs over 400 AI-powered security checks in seconds to catch up to 95% of fake IDs including:

- Hologram checks

- IR scanning

- Template checks

- Crossmatching

- White light scanning

- Watermark checks

- UV scanning

- Barcode checks

If the ID is legitimate, the “Passed” pop-up will appear after the information is populated, and you can proceed with the application.

Learn more about using MeridianLink with ParseLink integration.

Scanning IDs into MeridianLink

Use ParseLink to easily authenticate IDs and send clean, accurate data into MeridianLink banking software.