Canada has been actively strengthening its anti-money laundering (AML) and anti-terrorist financing (ATF) laws under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). In recent years, the government has accelerated regulatory amendments that expand the scope of reporting entities and tighten compliance requirements. Effective April 1, 2025, several previously unregulated sectors, including financing and leasing companies, factoring firms, and check-cashing businesses, became reporting entities subject to the full suite of AML obligations, narrowing gaps that criminals could exploit.

Under these changes, all reporting entities must enroll with FINTRAC (the Financial Transactions and Reports Analysis Centre of Canada), implement an AML compliance program, verify client identities, monitor and report transactions, and keep detailed records. This expansion is part of broader legislative efforts, including aspects of Bill C-2, that also introduce enhanced enforcement powers and higher penalty caps for AML violations.

How these rules impact Canadian businesses

The expansion of AML requirements reaches far beyond traditional banks and financial institutions. Canadian businesses that provide financing or leasing services, such as automotive dealerships, are now squarely within FINTRAC’s regulatory scope. As of April 1, 2025, any dealership that engages in in-house financing or leasing of passenger vehicles (or financing/leasing of business property outside of real estate) must operate as a reporting entity under the PCMLTFA.

This obligates these businesses to embed AML considerations into their daily operations. Dealerships must assess risks, implement written policies and procedures tailored to money laundering and terrorist financing risks, designate a compliance officer, and train staff on regulatory duties. Record keeping is also critical, for example, capturing client identification data, transaction histories, and documentation of due diligence efforts, and must be maintained and accessible for regulatory review.

Beyond dealerships, other industries now under FINTRAC’s regulatory umbrella (or being phased in via guidance and timelines) include mortgage entities, check cashers, and factoring firms. These changes reflect a broader push to ensure AML compliance across sectors where significant value transfers occur.

How IDScan.net can ensure compliance with Canada’s AML regulations

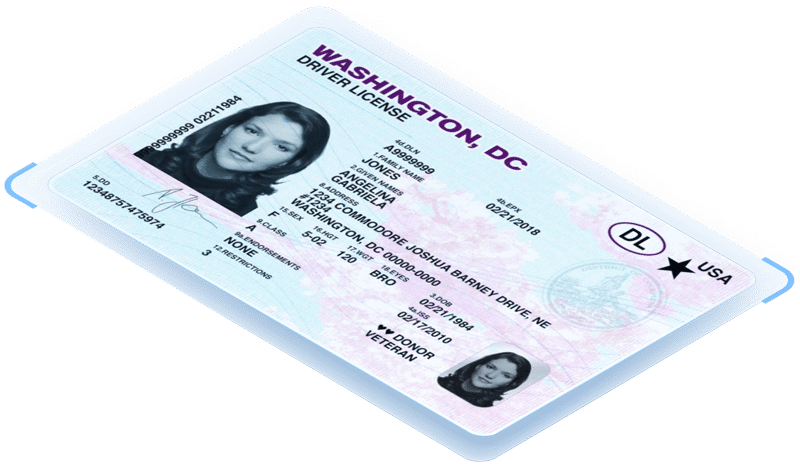

Compliance with AML and FINTRAC requirements is data and process-intensive. Solutions like VeriScan Identity Platform can be a powerful asset in helping Canadian businesses meet these obligations.

- Verify customer identities remotely or on site.

- Reduce fraud risk without adding friction

- Maintain compliance with KYC and AML regulations

By seamlessly integrating these capabilities into a business’s existing workflows, IDScan.net helps organizations build robust AML compliance frameworks that are defensible, scalable, and easier to manage over time.

Penalties for non-compliance with Canada’s AML regulations

FINTRAC has broad authority to enforce compliance and penalize violations of AML regulations. Penalties vary based on the severity and nature of the violation. Administrative monetary penalties (AMPs) can range from modest fines for minor non-compliance issues to significantly larger penalties for serious or very serious breaches. In recent iterations of regulatory reforms, maximum penalties have been proposed to escalate substantially, with caps reaching up to $20 million for very serious violations and tied to a percentage of global revenue for larger entities under Bill C-2-related changes.

In addition to financial penalties, FINTRAC can publicly disclose enforcement actions, which can have reputational fallout for businesses that fail to meet their obligations. In severe cases, failure to comply with AML obligations can attract criminal charges, particularly where deliberate or egregious misconduct is involved. Recent high-profile enforcement actions in Canada illustrate that regulators are willing to impose significant fines for systemic AML failures.

For dealerships and other newly regulated sectors, understanding these risks, and building compliance programs accordingly, is essential not just to avoid fines, but to protect operations, reputation, and customer trust.

Conclusion

Canada’s AML landscape is rapidly evolving, with expanded obligations bringing new types of businesses, especially those involved in financing and leasing, into the regulatory fold. These changes require formal compliance programs, careful risk management, thorough identity verification, and meticulous reporting. Businesses that adopt structured approaches, supported by technologies like VeriScan, will be better positioned to meet regulatory expectations and avoid costly penalties. As regulations continue to strengthen, proactive compliance is no longer optional; it’s a core part of responsible business operations.