Credit card chargebacks are one of the most frustrating and costly issues faced by retailers, bars, dispensaries, and other merchants involved in customer transactions. Whether it’s a fraudulent transaction, a customer disputing a legitimate purchase, or misuse of a payment method, chargebacks not only cost businesses money, they also jeopardize their merchant processing status.

Fortunately, identity verification tools, like VeriScan, offer a powerful line of defense. By incorporating ID scanning into your current workflow, especially at the point of sale, you can collect critical data that helps reduce chargeback risk and provide the documentation needed to dispute them successfully.

What is a credit card chargeback?

A chargeback occurs when a credit card issuer forcibly reverses a transaction at the request of the cardholder. While intended as a consumer protection mechanism against fraud, chargebacks are often misused by fraudsters themselves. Merchants are then left to prove the transaction was valid, often with limited evidence.

Why credit card chargeback protection matters

Beyond the financial toll of credit card chargebacks—lost revenue, restocking costs, and chargeback fees—businesses that accumulate too many disputes may face increased processing fees or even lose their ability to accept credit cards. VeriScan offers a preventive and defensible solution that helps maintain your processing privileges and protect your bottom line.

How can ID Scanning fight credit card chargeback disputes?

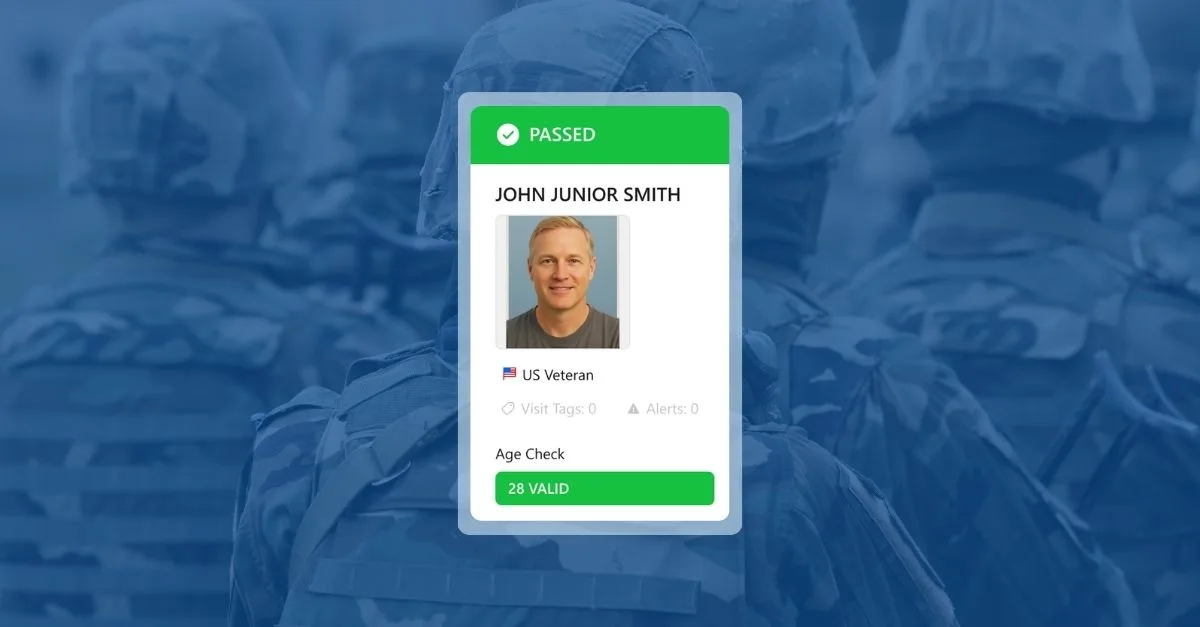

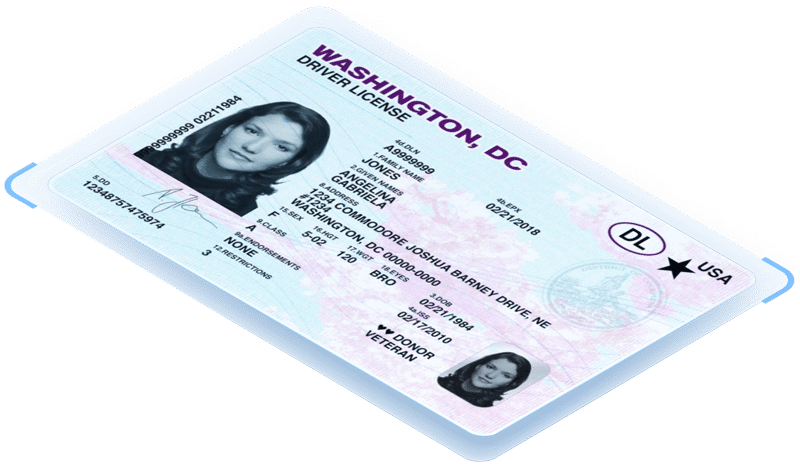

By scanning a government-issued ID at the point of sale, merchants can collect and store a digital record of who was present during the transaction, as well as capture images of the credit card used during the transaction. VeriScan enables this process by transforming a simple ID scan into a detailed, time-stamped record.

This is especially valuable for high-risk industries, such as:

- Tobacco and vape retailers

- Cannabis dispensaries

- Bars and nightclubs

- Luxury goods or electronics retailers

- Hospitality and event venues

When a chargeback occurs, a business using VeriScan can provide financial institutions with a detailed record from the customer interaction, including, all information embedded in the 2D barcode, MRZ or RFID chip of a driver’s license or passport, a time-stamped scan of the customer’s ID, POS transaction logs matched to the ID scan record, and more.

This documentation forms a powerful evidence package that can be submitted to the bank to contest fraudulent chargebacks, demonstrating the cardholder was physically present and verified at the time of purchase.

Can ID scanning be integrated into existing workflows?

Yes. VeriScan visitor management solution easily integrates into existing workflows or establishes new ones when the need arises. This seamless workflow enhances operational security without adding friction to the customer experience.

Real-world application: retailers and dispensaries

In high-volume, high-ticket environments, like cannabis dispensaries or electronics stores, chargebacks can be especially damaging. VeriScan not only verifies the age and identity of the buyer, but can be configured to log each transaction along with ID data.

If a customer later claims they never visited the store or never made the purchase, the business can refute the claim with confidence. And in the case of “friendly fraud,” where the actual cardholder disputes a valid charge, they may be far less likely to succeed if your evidence includes a time-stamped scan of their state-issued ID.

Conclusion:

Fighting chargebacks starts with proof, and ID scanning is one of the most effective ways to gather it. With VeriScan, merchants can not only verify identity and age but also build an irrefutable paper trail to protect against fraud and false claims. In a customer-facing landscape increasingly vulnerable to scams, implementing this technology isn’t just smart, it’s essential.